Andy Roberts

My Fellow Partners,

As we close the chapter on 2024, I am writing to provide you with an update on the Mayar Responsible Global Equity Fund’s performance and share our perspectives on the current market environment.

Our Performance

For the twelve months ending December 31, 2024, the Mayar Responsible Global Equity Fund (Class A) was down 1.45% net of all expenses and fees, while the MSCI World Index increased by 18.67% in the same period. Since its inception in May 2011, the Fund has seen a 194.75% increase versus a 256.09% increase for the MSCI World. This corresponds to an 8.23% annualized rate of return for the Fund, compared to 9.74% for the MSCI World.

General Commentary

There are no new stories in the stock market, only new investors.

– Wall Street saying

The “Magnificent Seven” and Market Concentration

2024 was a year of extraordinary market concentration, posing significant challenges for active managers like us. This past year has been very challenging for active managers due to the significant concentration of returns in a small number of mega-cap technology companies (the ‘Magnificent Seven’). Consequently, this environment is especially difficult for valuation-sensitive investors like us.

Valuations in the US market, particularly in the technology sector, reached multi-decade highs in 2024, both in absolute terms and relative to other industries and geographies.

History provides a stark warning about this kind of market environment. Such extreme valuations in US equities have only occurred twice in the past century, and both times resulted in negative real returns over the following decade. Similar patterns have been observed in other markets as well.

While some argue that “this time is different” due to the profitability and growth of these companies, we believe this argument overlooks the crucial factor of valuation. Even profitable, growing companies can deliver poor returns if their valuations are excessively high, as seen during the dot-com bubble. Their sky-high valuations simply over-discounted their future growth potential, leading to poor investor returns.

The Cisco Systems Case Study

Consider Cisco Systems (CSCO) in the late 1990s. It was a phenomenal business, essential to the growth of the internet at a time when internet usage was growing at an incredible rate. Cisco became a stock market darling, and its market cap topped $500 billion in March 2000, making it the world’s most valuable company.

Yet even with continued impressive growth in sales (3.3 times) and Earnings per Share (4.2 times) in the 8 years following the dot-com bubble, Cisco stock still delivered a cumulative loss of 80% to investors!

Cisco’s stock was so overpriced that even when we look at a longer timeframe, from March 2000 to December 2024, a period during which Cisco’s business performance remained respectable with sales growing 4.5 times and an 8-fold growth in earnings per share, shareholders still experienced a cumulative loss of -26% (-1.2% annualized), and only broke-even on their investment 25 years later, with dividends included.

This highlights a crucial point: even with stellar business performance, overpaying can lead to disappointing investment outcomes, even when measured over the long term. This tendency to overpay for growth is not limited to the dot-com era; we see echoes of it today.

Nvidia: A Modern-Day Parallel?

Nvidia (NVDA), a dominant player in the AI chip market, currently trades at a high multiple of sales. To justify its current valuation and generate positive returns in the next 5 years, several optimistic assumptions must hold true: continued hypergrowth in sales volume, stable product prices, sustained record-high margins, and a persistently high valuation multiple.

However, Nvidia’s continued dominance is not guaranteed. Competition is increasing, with rivals like AMD developing competing products and major customers like Google (GOOG),(GOOGL), Amazon (AMZN), [[Meta]], and Microsoft (MSFT) creating their own custom AI chips. This competition will likely pressure prices and compress margins.

Current estimates from Wall Street analysts assume Nvidia will maintain operating margins at levels that are more than double their historical average, and that are actually higher than the company’s average historical gross margins!

I strongly believe it is highly unlikely that will happen as the industry transitions from a situation with a monopoly producer and period of supply shortages into an environment with more competition and a readily available supply.

If we assume continued strong growth in volume, but with pricing moderation leading to operating margins moving closer to their historical norms, Nvidia’s stock price could have 70% downside from current levels.

In fact, even under Wall Street analysts’ heroically generous assumptions about Nvidia’s future growth and margins, it’s challenging to see Nvidia’s stock generating much better than mid-single-digit returns for several years to come.

Absurdity in the Market

Some have argued that the current stock market lacks the widespread exuberance of the dot-com era. So, allow me to highlight some of the pockets of absurdity that do exist. One example is MicroStrategy (MSTR), a software company that has effectively transformed itself into a leveraged bet on Bitcoin by issuing (a lot!) of equity and debt to buy Bitcoin (BTC-USD).

Their investor relations website describes the company this way:

“MicroStrategy (Nasdaq: MSTR) is the world’s first and largest Bitcoin Treasury Company. We are a publicly traded company that has adopted Bitcoin as our primary treasury reserve asset. By using proceeds from equity and debt financings, as well as cash flows from our operations, we strategically accumulate Bitcoin and advocate for its role as digital capital.”

MicroStrategy has spent over $27 billion accumulating a staggering 447,470 Bitcoins. At today’s Bitcoin price, the market value of their Bitcoin portfolio is $41 billion.

Their stock, which was trading around $50 in early 2024, skyrocketed during the year, peaking at $543 before ending the year at $290. That generated a lot of excitement and love from irrational traders!

So much excitement, in fact, that at today’s stock price, MicroStrategy has an enterprise value of $90 billion, which means that the company is valued at more than double the underlying market value of the Bitcoin it owns (the company’s other assets are relatively negligible in value).

But that level of excitement doesn’t seem to be enough for some people. REX Shares and Tuttle Capital Management recently launched the Defiance Daily Target 2X Long MSTR ETF, which tries to use leverage to produce double the returns on MicroStrategy stock. I don’t think I’m going out on a limb if I say that irrational exuberance is alive and well! This won’t end well.

The AI Hype Cycle

While we recognize the revolutionary potential of AI, history suggests that people tend to overestimate the short-term impact of new technologies and underestimate their long-term effects (Amara’s Law, named after the American scientist and futurist Roy Amara).

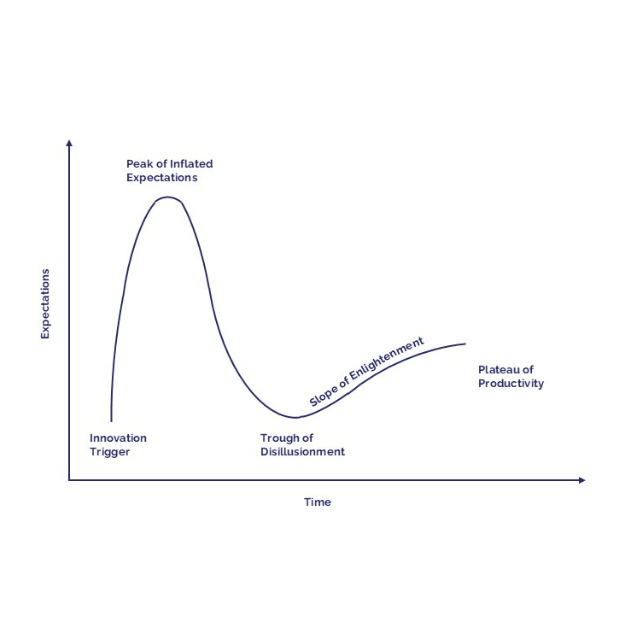

This pattern often leads to a hype cycle, famously depicted by research firm Gartner, with new expectations about technologies quickly inflating into a peak then followed by a crash as reality sets in, leading to a period of disillusionment, followed by a recovery and eventual stabilization.

Mayar Capital

As patient investors, we prefer to wait and invest in technologies once they are more established and valuations are more reasonable.

This tends to happen after that “trough of disillusionment”. Investing at that point has many advantages. (1) the new technology is more established and it’s clearer whether it will succeed; (2) the market has had a big shake-up, and many companies have left the industry, making it easier to see which companies will succeed and (3) valuations are usually depressed giving us a margin of safety on our purchase.

“Boring is Beautiful”

Our research into the best-performing stocks over the long term reveals a striking pattern: in periods of market euphoria such the late 1990s, the stocks of these high quality best performing “boring” companies tend to underperform. This pattern repeated recently with almost two-thirds of the best performing stocks over the past 30 year underperforming the market in 2024 as capital flowed into high-growth technology companies.

We believe this trend is temporary. History shows that once the euphoria “pops”, these stocks tend to outperform and in fact many produce positive results even when the index is declining. We believe this pattern will repeat itself.

Our Outlook

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

I generally avoid making short-term market predictions. Markets are inherently unpredictable, and it’s often difficult to filter out the noise and identify truly significant signals. However, periods of extreme investor sentiment – whether excessive optimism or pessimism – can create compelling investment opportunities. We believe the current market presents such an opportunity.

So, while I have typically refrained from making predictions, there have been a few instances where prevailing market sentiment was so extreme that I felt confident in deviating from this approach. Those instances, driven by my conviction about clear market imbalances, have resulted in some of our most successful investments.

Today, we see a similar situation. We believe a correction in technology stocks is highly likely, and given their significant weight in major indices, this could drag down the broader market. However, we view this potential downturn as an opportunity.

We are optimistic about the prospects for quality value stocks and non-US markets, where valuations are more reasonable and economic conditions are improving. We believe they will not only outperform major US indices going forward but will generate very satisfactory absolute returns. Our patience will be rewarded.

OUR PORTFOLIO

We were actively managing the portfolio this past quarter, capitalizing on market volatility. We added to our investments in Vistry (OTCPK:BVHMF), Nestle (OTCPK:NSRGY), Solventum (SOLV), Ashtead (OTCPK:ASHTF), Capgemini (OTCPK:CAPMF), and Samsung Electronics (OTCPK:SSNLF) and trimmed our holdings in PayPal (PYPL), Electronics Arts (EA), SAP, and Labcorp (LH) and fully exited our investment in Howdens Joinery (OTCPK:HWDJF).

This quarter, we also purchased shares in L’Oreal (OTCPK:LRLCF), Johnson Service Group (OTC:JSVGF), and 4imprint (OTCPK:FRRFF). L’Oreal will likely be familiar to readers as a stable of premium beauty brands. 4imprint, a distributor of promotional products (think company-branded mugs and the like) has been on our radar for a number of years: an unlikely high-quality gem with, we believe, an enormous runway to grow profits in future. Johnson Service Group, finally, is a rental business which rents out flat linen such as bedsheets, towels and napkins for hotels and restaurants, as well as a smaller business renting out workplace uniforms. Another hidden gem, this business has attractive unit economics and good growth prospects.

As the debate around AI rages, we are sticking with what we know best: investing in high quality, boring businesses with strong fundamentals and attractive long term growth prospects at reasonable valuations.

THE FUND AND THE COMPANY

We acknowledge that the past three years have been disappointing. However, we remain committed to our long-term value investing principles. History has shown that periods of underperformance are often followed by periods of significant outperformance for disciplined value investors.

It is for those reasons that I am excited about the future. We currently own a portfolio of high-quality businesses with attractive future growth prospects. These businesses are trading at a significant discount to their intrinsic value, making them a compelling investment opportunity for us. I am extremely confident that the next 3 years will be rewarding for our investors.

Mayar Capital ended the quarter with $405.7 million in Assets Under Management (AUM).

Thank you again for your continued partnership. We appreciate your continued patience, support, and trust. We are committed to delivering outstanding results and building long-term value for you.

As always, please do not hesitate to reach out with any questions. Best regards,

Abdulaziz A. Alnaim, CFA Managing Director

Business Summary: Ashtead Group

Headquarters: London, United Kingdom

Founded: 1947

Ashtead Group is a leading international equipment rental company, providing an extensive range of industrial and construction equipment to businesses and individuals. Operating primarily under the Sunbelt Rentals brand throughout the United States, Canada, and the UK, Ashtead serves a wide variety of industries, including construction, manufacturing, infrastructure, and event management. The company’s inventory includes everything from aerial work platforms, forklifts, and earthmoving equipment to smaller tools and climate control systems. This may not be a particularly exciting business, but its attractive unit economics and secular growth trajectory – as companies are increasingly renting rather than owning equipment – means this has been a great stock to own for many years, and we believe will continue to be such.

Founded in 1947 in the United Kingdom, Ashtead initially focused on plant hire services, primarily serving the UK market. Over the decades, the company steadily grew through organic expansion and strategic acquisitions, eventually entering the North American market, which has since become its primary driver of growth. The pivotal moment in Ashtead’s history came with its acquisition of Sunbelt Rentals in 1990. This move allowed the company to establish a significant foothold in the U.S., a market that now accounts for the lion’s share of its revenues and profits. The North American equipment rental market is not only larger than the UK’s but also offers higher growth potential due to the broader adoption of the rental model across industries. Ashtead’s subsequent investments in the U.S. have been instrumental in its transformation into one of the world’s largest equipment rental companies. Today, while its roots are firmly in the UK, Ashtead is predominantly a North American-focused business.

A significant aspect of Ashtead’s appeal lies in its consistently strong returns on invested capital. Ashtead is able to purchase equipment at a discount from original equipment manufacturers since the company is often a very important customer for these manufacturers. It is able to generate approximately $60 a year in rental revenue for every $100 invested in equipment, at a 45-50% profit margin, and is often able to sell the equipment six or seven years later for some 35% of the original purchase price. This represents a 22% pre-tax return on investment, which is very attractive. Moreover, Ashtead’s decentralized branch structure, where individual locations cater to the specific needs of their local markets, enhances customer satisfaction and operational flexibility. Furthermore, Ashtead has effectively leveraged technology and data analytics to optimize its fleet utilization, pricing strategies, and customer relationships, reinforcing its competitive advantage.

Looking ahead, Ashtead’s growth prospects remain robust, particularly in North America. Ongoing infrastructure investment in the U.S., spurred by substantial government funding initiatives, presented a significant tailwind for the company during the Biden administration and will likely continue under the incoming Trump presidency. Projects involving roads, bridges, energy infrastructure, and urban development are expected to drive strong demand for rental equipment. There continues to be a trend of US companies increasingly renting equipment from the likes of Ashtead or United Rentals, rather than buying equipment themselves. Ashtead is well-positioned to capture these opportunities due to its experienced and capable management team, extensive depot network, and strong financial position, which enables continued investment in its fleet and branch expansion. Additionally, the company’s strategy of acquiring smaller regional players allows it to grow its market share while maintaining operational efficiency.

A potentially transformative development for Ashtead is its consideration of a U.S. listing, which the company said it was considering recently. Relisting in the U.S. would align Ashtead’s domestic equity market with its primary operating market, which could well help the rating of the shares.

In the business of equipment rental, scale matters a lot: it is the key to driving equipment utilisation and securing good terms from the equipment manufacturers, and Ashtead’s strong #2 position means it, alongside United Rentals, should continue to capture market share in this structural growth market. Combining these strong unit economics with a long growth trajectory into the future means that Ashtead ought to continue to be a good stock for a long time to come.

#Mayar #Capital #Letter #Partners