Vertigo3d/E+ via Getty Images

Fellow Investors,

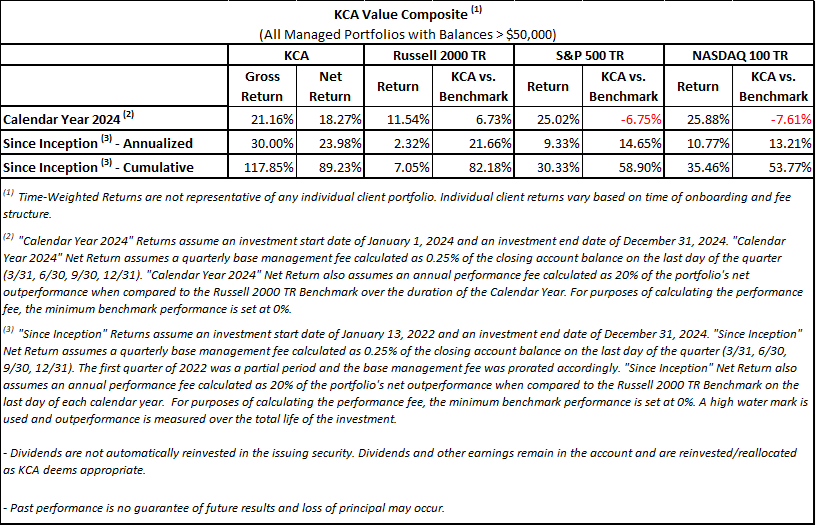

The conclusion of 2024 marks the third year of Kingdom Capital Advisors’ existence. Since our inception, small cap stocks (as measured by the Russell 2000 TR) have returned about 7% cumulatively, versus 89% for KCA. We continue to apply our concentrated approach, seeking to maximize the growth of your entrusted capital.

Kingdom Capital Advisors (KCA Value Composite) returned2.07% (net of fees) in the fourth quarter, vs. 0.33% for the Russell 2000 TR, 2.41% for the S&P 500 TR, and 4.93% for the NASDAQ 100 TR. As a reminder, returns will vary by account due to rounding, fee structure, account size, and timing of withdrawals or deposits during the year.

The fourth quarter became “much ado about nothing.” The election of Donald Trump sparked a November rally in small-cap stocks, but nearly the entire gain reversed by year’s end. KCA’s portfolio experienced a similar boom and bust during this time.

Our top contributors to Q4 returns were United Natural Foods (UNFI) and National Presto Industries (NPK), while Superior Industries (SUP) and Enzo Biochem (ENZ) were our largest detractors. For the full year, Net Lease Office Properties (NLOP) and UNFI were our top contributors, while ComScore (SCOR) and Superior Industries were the largest detractors.

Our Approach

Since launching KCA, I have consistently worked to improve our investment process, and thus our returns. There are a few specific tensions we’ve tried to manage over the past three years:

-

We are ultimately judged on performance. When our portfolio exceeds our benchmark, we have succeeded and vice versa. However, if our stocks appreciate for reasons outside our investment thesis, our success should be attributed more to luck than skill. We examine the root cause of why ideas worked, or failed, to improve our analysis in the future. For example, NLOP has followed our thesis and significantly appreciated; whereas Regis Corporation (RGS) secured a highly accretive refinancing of their debt, more akin to an out-of-court bankruptcy filing, which ultimately increased the stock more than 300%. We were in the right place at the right time with RGS, and while this restructuring was not what we anticipated, it provided a lucky (and very profitable) outcome.

Our investment in NLOP was a reminder that uncorrelated trades can be overshadowed in a bull market. I remain confident this investment would have been successful whether the market was up or down 20% this past year. Perhaps commercial lending would have frozen, but many of their sales were to existing tenants buying out of their lease – deals that could have happened regardless of credit conditions in commercial real estate specifically. Furthermore, not all the sales have been favorable – multiple European properties significantly underperformed my expectations, including a UK building that just sold for nearly a 100% cap rate. All this to say, it is difficult not to “chase the market,” but providing consistently positive uncorrelated returns will win out in the long term. Which brings me to my next point.

-

Investment timeline is important. We report our returns to investors quarterly, but is that an appropriate period of measurement? It depends. For instance, our performance has significantly benefited from metallurgical coal stocks since we launched, but there have been extended periods where our positions have traded sideways and down. In the fourth quarter alone, Warrior (HCC) started around $60, traded up to $75 and ended the year under $55 – was the 12/31 price the “best” one to judge our performance?

We have tried to become more flexible about taking profits when prices exceed short-term expectations, and quicker to cut bait when timelines get extended. Some dislocations are brief, some persist, and some were just bad ideas. In general, we look for investments that will achieve fair value in less than three years.

-

The macroeconomic backdrop is important and influences our returns in the short term. We strive to provide uncorrelated outperformance, but that doesn’t completely exempt our portfolio from broader market influences. To this end, if the market crashes 3% in a day, we are not surprised to see our portfolio do the same. If the fear of the day doesn’t disrupt our thesis, these moves generally correct in short order. We avoid investments where success is solely dependent on specific macro outcomes – i.e. interest rate moves or the price of oil. We’d rather focus on finding the next NLOP or Unit Corporation (OTCQX:UNTC), trades we expected to perform well through a variety of macro backdrops.

There’s more for us to learn, and we look forward to further refining the investment process in 2025.

Positioning Updates

Net Lease Office Properties, our largest position, was our most profitable investment in 2024. Our thesis was simple – we were purchasing shares below our anticipated liquidation value, with a possibility of 2-3x upside. NLOP has doubled our initial purchase price, and we have increased our investment as property sales exceeded expectations. We believe the liquidation “cone of uncertainty” is narrowing around $45/share (~50% further upside). Given the pace of sales and pending properties currently expected to close, we are hopeful this value is mostly realized during 2025.

Another significant contributor to our 2024 performance was United Natural Foods, which I highlighted last quarter. As expected, UNFI proved their turnaround is real, achieving their expected annual cash flow improvement in just the first fiscal quarter. There are a few key levers I expect UNFI to pull, namely consolidation of their distribution centers, selling assets, and increasing margins on their operations through better supplier agreements. Food distribution peers have consistently shown 2.5% margins are achievable in this space. UNFI returning to 2.5% margins would increase EBITDA by 50% over FY24, and I think this is achievable within a couple of years. Much of this EBITDA improvement should be converted to cash, significantly improving UNFI’s balance sheet. I also love the counter-cyclicality of UNFI’s grocery distribution business, as consumers trade down from restaurants when budgets are tight. I see a clear path to UNFI’s stock doubling within the next two years if they continue to execute their turnaround strategy.

Also, among our key 2024 contributors, we are waiting for Galaxy Gaming (OTCQB:GLXZ) to finalize its sale to Evolution (OTCPK:EVVTY). Shareholders voted to approve the deal in November. Though illiquid, the GLXZ stock trades at $2.75/share versus the $3.20 sale price. Assuming a mid-year close, this yields about a 33% IRR, and we plan to hold the shares rather than selling before the deal closes. We are glad that Evolution carries almost 10x the cash needed to close the acquisition, introducing little counter-party risk. In the event the deal breaks, GLXZ will be trading below 10x EBITDA and receive a sizable $5m break payment.

In terms of detractors, we are disappointed in the decline in Superior Industries (SUP), but we continue to think SUP is making the most of a tough environment. SUP manufactures aluminum wheels in both Mexico and Poland. Fears of new tariffs on their Mexican production are understandable; however, only 10% of the US aluminum wheel market is manufactured domestically, and the rest is evenly split between China and Mexico. We see little likelihood that Superior will lose meaningful sales to domestic production or Chinese producers in the event of increased tariffs. Furthermore, if Chinese imports are hit with higher tariffs this could prove to be a tailwind. A significant decline in US auto manufacturing remains a risk, yet new car sales have remained strong in recent months. IHS estimates SUP’s key customers’ production will decline slightly in FY25, but we expect SUP to maintain flat volumes and $175m of EBITDA in that environment, more than adequate to service their debt.

Enzo Biochem also declined significantly in December after their FYQ1 revenue decreased 20%. Enzo now trades for less than the cash on their balance sheet ($38m market cap versus >$40m of cash). We expect their eventual liquidation will produce upside; however, the revenue decline in their business significantly reduces the potential proceeds. Recent legal developments suggest the final barriers to liquidation are being removed, but the shareholder base appears exhausted from continued disappointments.

Lastly, as we noted in an email to you last week, Corsa Coal (OTCQX:CRSXF) unexpectedly filed for bankruptcy on January 6th. We are actively working to clarify the reasons for this decision and seeking to facilitate an outcome for shareholders that doesn’t result in a total loss. We remain confident the operation had value that should be recognized on behalf of shareholders through this process.

New Positions

Our most significant addition in Q4 was Magnera Corporation (MAGN). The product of a merger between Glatfelter and Berry’s HH&S businesses, Magnera began trading independently in November. The combined entity should file their 10-K shortly and report their Q1 in February, after which we expect the improvement in volumes for their non-wovens will become apparent. This is not an exciting business, producing products like wipes, diapers, etc. Magnera was spun with a significant amount of debt, but we interpret their upsized $800m notes offering as a sign that the business is turning. The debt is cheap, termed out, and backed by significant assets. We expect Management to focus on deleveraging quickly. As a bonus, some of their business lines were impacted by cheap imports in recent years, and I expect Magnera could be a beneficiary of a tougher tariff regime. At a high level, here is our investment framework:

-

Magnera should have about $1.8B of net debt after the spin, and 36m outstanding shares, with about $400m of EBITDA. Shares currently trade at $18.

-

I think Magnera can generate >$100m of annual FCF for the next three years, while growing EBITDA to $475-500m via synergies and volume recovery. These businesses have averaged over $500m of annual EBITDA in the past decade, suggesting this normalization is not overly aggressive.

-

At their current 6x EBITDA multiple, that would imply the business trades for $40/share within three years (~120% upside/30% IRR).

We also established a position in National Presto Industries (NPK), which has already appreciated substantially. From glancing at NPK’s annual report, you would think they primarily sold small appliances. Instead, about 75% of their revenues are derived from 40mm ammunition sales (grenades). The backlog in the defense segment has “exploded,” doubling over the last nine months, but the stock price had not followed. The market now seems to be catching onto the expected revenue acceleration in FY25. At a high level, we think NPK can convert this backlog into about $200m of cash flow over the next three years, absent additional contract wins.

Lastly, we (finally?) became AI investors in Q4. TSS Incorporated (TSSI) was added to the portfolio, having already returned over 1000% in FY24 on the strength of Dell’s demand for new server racks. Mike was fortunate enough to meet with the CEO in Chicago during the summer and came away extremely impressed with the company’s plan to expand their operations in the face of significant data center demand. Their involvement with xAI certainly seems like a tailwind for 2025. While we do not usually find ourselves wanting to pay 30x run-rate earnings, a company that grew revenue almost 700% in the most recent quarter can catch your eye.

Business Update

We are extremely grateful to those that have referred potential investors to help us grow! We continue to publish research online, participate in occasional podcasts, and network with like-minded managers in the quest for our next great investment. We are lining up our conference agenda for the year. In January I am heading to ICR in Orlando, and I plan to be in Vegas in April for the MicroCapClub/Planet MicroCap combined event. If you find yourself in the DC or Richmond area, we would love to see you.

Thank you for trusting us to steward your funds wisely. As always, reach out with any questions.

Sincerely,

David Bastian, Chief Investment Officer

|

DISCLOSURES This document is not an offer to invest with Kingdom Capital Advisors, LLC (“KCA” or the “firm”). The statements of the investment objectives are statements of objectives only. They are not projections of expected performance nor guarantees of anticipated investment results. Actual performance and results may vary substantially from the stated objectives. Performance returns are calculated by Morningstar. An investment with the firm involves a high degree of risk and is suitable only for sophisticated investors. Investors should be prepared to suffer losses of their entire investments. Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “intend,” “continue” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of the firm described herein may differ materially from those reflected or contemplated in such forward-looking statements. This document and information contained herein reflects various assumptions, opinions, and projections of Kingdom Capital Advisors, LLC (“Kingdom Capital Advisors” or “KCA”) which is subject to change at any time. KCA does not represent that any opinion or projection will be realized. The analyses, conclusions, and opinions presented in this document are the views of KCA and not those of any third party. The analyses and conclusions of KCA contained in this document are based on publicly available information. KCA recognizes there may be public or non-public information available that could lead others, including the companies discussed herein, to disagree with KCA’s analyses, conclusions, and opinions. Upon request, KCA will furnish a list of all prior securities discussed in our publications within the past twelve months to include the name of each security discussed, the date and nature of each discussion, the market price at that time, the price at which the KCA acted upon the discussion (if at all), and the most recently available market price of each security. Funds managed by KCA may have an investment in the companies discussed in this document. It is possible that KCA may change its opinion regarding the companies at any time for any or no reason. KCA may buy, sell, sell short, cover, change the form of its investment, or completely exit from its investment in the companies at any time for any or no reason. KCA hereby disclaims any duty to provide updates or changes to the analyses contained herein including, without limitation, the manner or type of any KCA investment. Positions reflected in this letter do not represent all of the positions held, purchased, and/or sold, and may represent a small percentage of holdings and/or activity. The S&P 500 TR, Russell 2000 TR, and NASDAQ 100 TR are indices of US equities. They are included for information purposes only and may not be representative of the type of investments made by the firm. The firm’s investments differ materially from these indices. The firm is concentrated in a small number of positions while the indices are diversified. The firm return data provided is unaudited and subject to revision. None of the information contained herein has been filed with the U.S. Securities and Exchange Commission, any securities administrator under any state securities laws, or any other U.S. or non-U.S. governmental or self-regulatory authority. Any representation to the contrary is unlawful. This information is strictly confidential and may not be reproduced or redistributed in whole or in part. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

#Kingdom #Capital #Advisors #Investor #Letter