metamorworks

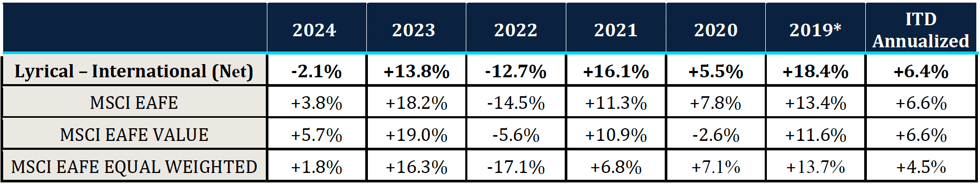

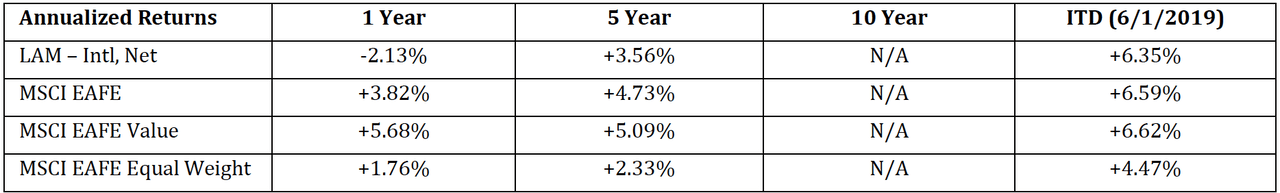

2024 was a disappointing year for our International Value Equity strategy which in USD returned -2.1%, compared to the +3.8% return of the EAFE and the +5.7% return of the EAFE Value.

The headwinds we faced in 2024 can be separated into three categories. First, the influence of mega-cap stocks drove the cap-weighted EAFE to outperform the equal-weighted EAFE by 210 bps. Over the past 30 years, the cap-weighted EAFE index has underperformed the equal-weighted index by 40 bps annualized. However, in 2024 it was the opposite, creating a headwind to our performance, as we have found the higher-quality values we seek outside of the mega-cap range.

Second, two stocks in our portfolio accounted for significant negative attribution. Both stocks had positive earnings growth in 2024, but they suffered from severe P/E multiple compression, causing negative returns. We believe there is a strong case for the long-term success of both these stocks, which we will elaborate below.

Finally, relative to our style benchmark of the EAFE Value Index, we had additional underperformance due to the performance of banks, which propelled the Financial sector within that index to a 25% gain in the year. We don’t own banks due to their extreme tail-risk, and lack of analyzability. Avoiding banks has been a long-term positive, as they have delivered flat returns over the past twenty years. That said, even bad industries can have a good year or two, and we believe that was the case in 2024.

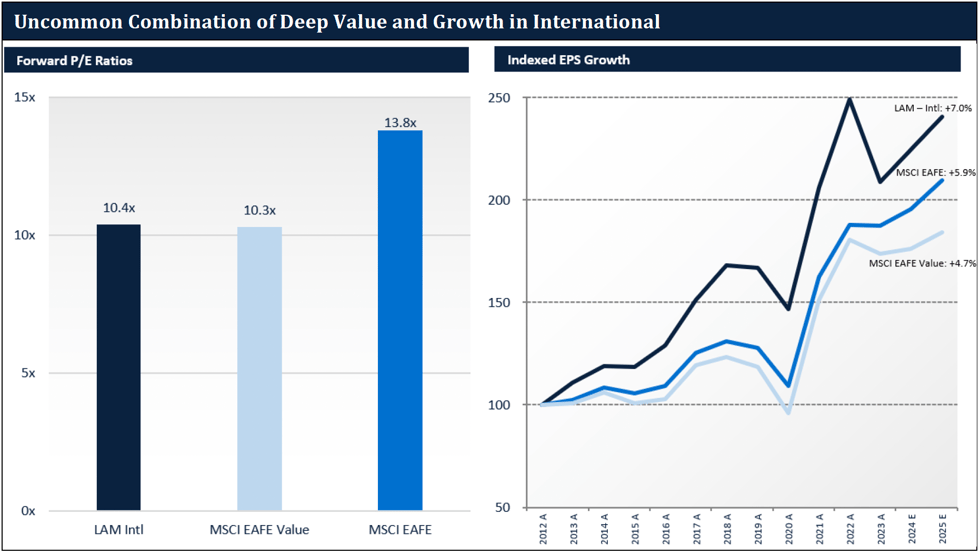

Looking forward, we have high expectations for portfolio returns, supported by our uncommon combination of an attractive valuation and strong earnings growth. The portfolio is trading for 10.4x 12-month forward earnings, while the MSCI EAFE is 33% higher at 13.8x. Meanwhile, our current portfolio has generated more than 100 bps per year better earnings growth than the MSCI EAFE. With more than 75% upside to our estimate of intrinsic value, we believe this sets us up for significant outperformance in the future.

*Partial year, inception date 5/31/19. Past performance is not necessarily indicative of future results.

WEIGHT MATTERS

Since we launched our strategy in 2019 we have been operating in an environment that is punitive to stocks outside of the largest-cap names. This has been a challenge for our fund, which—with an average $26 billion market cap—looks much more like the equal-weighted EAFE ($30 billion wtd. avg. mkt. cap) than the cap-weighted EAFE ($91 billion).

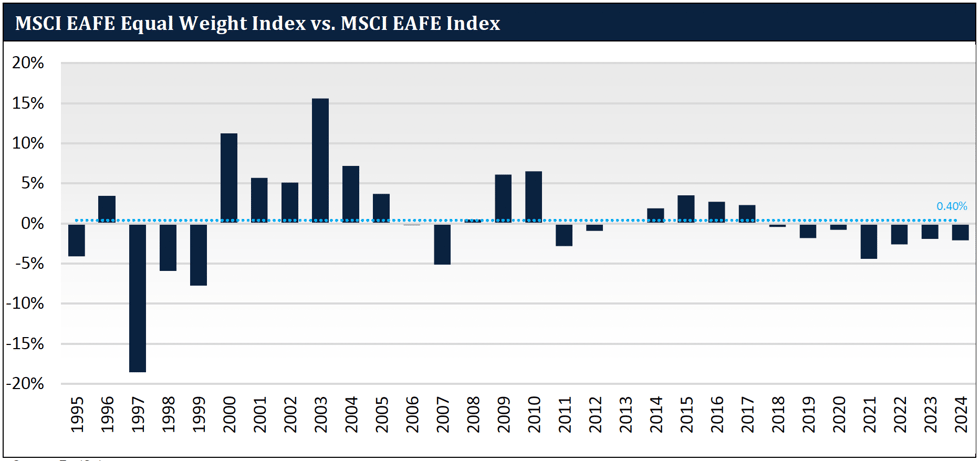

To illustrate this, we present the bar graph below which shows the year-to-year performance of the MSCI EAFE Equal Weight relative to the MSCI EAFE back to 1995, when the equal-weight index track record begins. As you can see, the equal-weighted index has now underperformed its cap-weighted counterpart for a record seven years in a row.

Source: FactSet

This has been an unusual period, and we do not expect it to persist. As you can also see in the graph, highlighted by the dotted blue line, the annualized return of the EAFE Equal-Weighted Index has been 40 bps better historically.

The only other period that resembles the past seven years was the tech bubble years of 1997, 1998, and 1999, when the EAFE outperformed by 18.5, 5.9, and 7.7 percentage points, compounding to a total of 41.7 percentage points.

Following those Tech Bubble years, the MSCI EAFE went on to underperform the MSCI EAFE Equal Weight index by 60.6 percentage points over the next six years.

The unusual recent outperformance of cap-weighted indices relative to the equal-weight index suggests that now may be a good time to be allocating to more equal-weight strategies.

LARGE-CAPS OR QUALITY-VALUE, BUT YOU CAN’T HAVE BOTH

In addition to better long-term performance, another good reason to invest outside of mega-cap companies internationally is that there are not many quality value businesses to be found there. We closely review the cheap companies amongst the mega-caps, and we don’t find many companies there that have both the quality and value characteristics we seek.

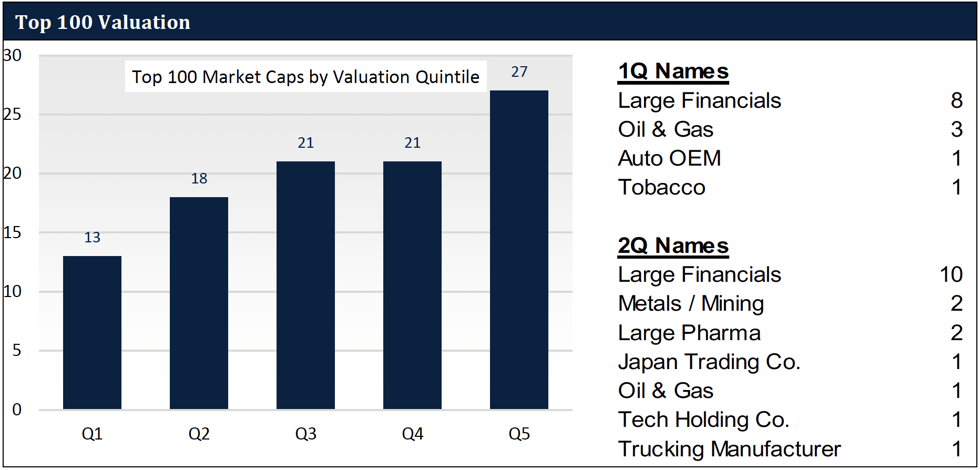

Our investment universe is the top 1,500 non-U.S. stocks within developed markets. Within that universe, the top 100 stocks are only 7% of the constituents, but make up a disproportionate 45% of the market cap. There’s a strong incentive for managers benchmarked to the EAFE to own these companies, as avoiding them creates tracking error. So, why don’t we own more of them?

Let’s first take a closer look at those 100 stocks and where they rank by valuation, using our estimate of five-year forward earnings. In the table below, we tallied the number of stocks in each valuation quintile, with the cheapest on the left, and the most expensive on the right. There are only 13 stocks in the cheapest quintile, the fewest within any of the five valuation quintiles.

Of the 13 names in the cheapest quintile, eight are giant banks and insurance companies (like BNP Paribas (OTCQX:BNPQF)(OTCQX:BNPQY) and HSBC Holdings (HSBC)(HBCYF)), three are oil and gas companies (like BP (BP) and Shell (SHEL)(RYDAF)), one is an Auto OEM (Mercedes-Benz (OTCPK:MBGAF)(MBGYY)), and one is a tobacco company (British American Tobacco (BTI)(BTAFF)). All appear to be either complex and opaque, low growth, or both. If you favor quality growth and analyzability, as we do at Lyrical, these are not the value stocks you want to own.

Source: FactSet

HIGHER EARNINGS, LOWER VALUATION

Beyond the large cap drag, we had notable underperformance in two stocks, Samsung Electronics (OTCPK:SSNLF) and Teleperformance (OTCPK:TLPFF)(OTCPK:TLPFY), that detracted 3.1% from our return, explaining the rest of our underperformance versus the EAFE. These stocks declined 38% on average, despite delivering about 4.5% earnings growth over the course of the year, resulting in more than 40% valuation compression.

We believe the reason behind this compression in valuation is fear around how AI may impact these businesses in the future. In each case, we believe these concerns are exaggerated and create buying opportunities in fundamentally good companies at extreme prices.

SAMSUNG: A DELAYED AI BENEFICIARY

Samsung Electronics is an industry leader in three business lines: Device Solutions – DRAM/NAND memory chips and leading-edge semiconductor foundries; Consumer Electronics – including televisions and appliances; and Information Technology and Mobile Communications – mostly mobile phones. The company’s crown jewel is its Device Solutions business, where it is the largest global producer of memory chips and where it has consistently maintained a technology lead by investing significantly more in R&D than its peers.

With AI deployment requiring more and more memory chips, it would be reasonable to expect that Samsung would be an AI beneficiary. However, AI favors a kind of memory chip technology called High Bandwidth Memory (or HBM) where Samsung is not the leader. This has caused Samsung’s memory margin to fall from a historical 10%+ margin advantage over its peer SK Hynix to an 18% margin disadvantage in the fourth quarter of 2024. This is largely driven by SK Hynix’s (OTCPK:HXSCF) dominant position in higher margin HBM chips and by Samsung’s incremental R&D spend in its attempt to catch up.

With significantly more scale and 70% more R&D spending than peers, we expect Samsung to close the technological gap in the near term and capture the benefits of AI demand. The company believes its technology will be on par with the competition by the end of 2025.

It’s worth highlighting that, prior to AI, Samsung was the technology leader in HBM, before it shifted its focus away from this area of the market, which was relatively small and growing slowly. In 2024, the HBM market tripled to about $15 billion due to AI-related demand, and the market is expected to continue growing quickly.

At the end of the year, Samsung traded for 10x its earnings, which we believe are depressed, and below book value. The company also has about 25% of its market cap in cash and investments. We think this is exceptionally cheap for a company that has posted 7% earnings growth over the past 15 years, well above that of the EAFE.

TELEPERFORMANCE: ONE OF EUROPE’S BEST COMPOUNDERS AT 5x P/E

Teleperformance is a leading global Business Process Outsourcing (BPO) provider, which we believe investors are now treating like a commoditized call center business, and therefore likely to be an eventual loser to AI. As a result, its P/E multiple collapsed from 8x to 5x over the course of 2024.

This multiple compression has not been driven by the results, though, as Teleperformance continues to outperform even more value-add peers. For example, Teleperformance is expected to have delivered about 3% organic topline growth in 2024, ahead of the flat organic growth from Accenture, which is not perceived to be under threat from AI and has a forward P/E of 27x.

While AI brings uncertainty to any people-driven business like Teleperformance, we believe the company will continue to post strong results in the future due to its advantages.

First, Teleperformance is a technology leader in a highly fragmented space. As the largest BPO, Teleperformance still only commands a high-single-digit market share, and much of the market is comprised of smaller players that cannot afford to invest behind new technologies like AI. Teleperformance has a long history of helping clients automate as much as possible. While this has historically cannibalized a mid-single-digit percentage of revenue annually, Teleperformance has managed to grow organically at a 9% rate over the past decade, as its capabilities have allowed it to consistently gain market share. We expect this dynamic to continue, especially in an underpenetrated market where only about 28% of customer work that could be outsourced is being done so today.

Second, we believe the market underestimates the complexity of Teleperformance’s work. Only about half of the company’s revenues come from customer service, and only 5% of that is basic chat services. Teleperformance is helping its customers replace some of this volume over time with AI, but it is likely to be offset with increasingly complex and higher margin work, as has been the case historically.

To be clear, AI creates real uncertainty for Teleperformance’s future, and so we continue to extensively research this topic. To date, we have evaluated commentary from more than 40 experts in the industry, ranging from former employees of Teleperformance and peers to major customers and AI challengers. Our checks have come back strongly positive on the opportunity for Teleperformance to be a winner in the future as it has been in the past.

With Teleperformance, we own a high return on capital business, with a flexible cost base. The company has a long history of growing organically at a high-single-digit rate, with a high 90% customer retention rate and mid-teens EPS growth. At 5x earnings, we think the reward outweighs the risk.

BANKS HAVE BEEN SHORT-TERM WINNERS BUT LONG-TERM LOSERS

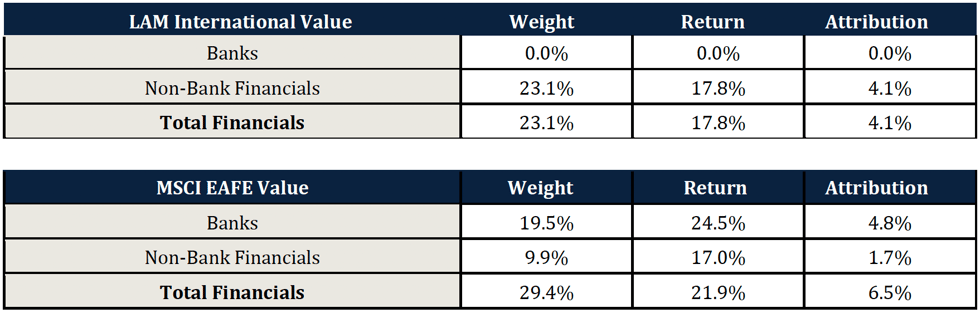

Relative to our style benchmark of the EAFE Value, our underperformance was explained by our lack of exposure to banks, which had an exceptional year in 2024. As you can see in the table below, we had less exposure to the Financials sector (23% v. 29%). Furthermore, our Financials performed well, returning 18%, but lagged the 22% sector return. Combined, this resulted in nearly 230 bps of negative attribution.

Financials are a broad category and our financial exposure looks very different from the index. In the EAFE Value, most of the Financials are comprised of large lending institutions, like HSBC and Banco Santander (SAN). We categorically avoid these stocks. In our portfolio, we select higher quality non-bank financials like an airplane lessor (AerCap (AER)), an exchange platform and data provider (Euronext), and a wealth management firm (Julius Baer).

The reason we don’t own large lending banks is because they don’t fit with our Analyzability investment criteria.

Analyzability means that we must reasonably be able to estimate long-term forward earnings power to effectively value a company. This keeps us away from businesses that are being disrupted and that are hard to predict. In our opinion, highly levered, diversified lending institutions are hard to predict. We can point to the obvious example of the Great Financial Crisis in 2008, but we can also point to the recent Silicon Valley Bank crisis and Credit Suisse collapse in 2023. Because it’s hard to analyze credit exposed bank balance sheets, it’s hard to conduct effective bottom-up research on large financial institutions. It’s because of these idiosyncratic risks that banks don’t make sense in our portfolios.

As bottom-up investors seeking to do effective business-specific research, we’ll stick to simpler and higher-quality companies. While we avoid many typical financial institutions, we still find many businesses within Financials that have analyzable structures. For example, Irish aircraft lessor, AerCap, is like a bank, except that its assets are highly analyzable: a collection of about 1,700 valuable planes, instead of millions of discrete loans. While airlines go bankrupt from time to time, AerCap’s assets are flyable, which means AerCap can easily recover its assets and lend them to someone else. As one of the largest purchasers of aircraft in the world, AerCap can purchase aircraft at a discount and therefore structurally earn higher returns on equity than smaller players.

Banks can be a short-term winner, but they’ve been long-term losers. Looking at the last four years, major banks in the EAFE Value have compounded at 20% per year, driving returns for both the value index and many traditional value managers. But zoom out longer, to 2006, and bank returns have been flat.

Timing the market is a loser’s game and, since inception, we’ve been operating in an environment where banks have performed well. Despite this, we’ve performed well in Financials without banks. Since inception, including 2024, our Financials attribution has slightly outpaced that of the EAFE Value.

Our bottom-up approach to finding quality value makes us look different than traditional value, evidenced by our 99% active share relative to the comparable benchmarks. Occasionally, as in 2024, this will hurt us, but over the long haul we are confident that our approach is the right approach!

OUR UNCOMMON COMBINATION

A signature trait of Lyrical portfolios is our uncommon combination of both deep value and quality growth. Shown in the left-side bar chart below is a summary of our current valuation, as well as the valuations of our benchmarks. Valuation is important, but it isn’t everything. What matters in investing is not just what you pay, but also what you get, specifically the future earnings.

Shown in the right-side line graph below is the growth profile of our portfolio and the benchmarks. The line at the top shows the EPS growth history of our current International portfolio, while the lines below it show the EPS growth of the MSCI EAFE and MSCI EAFE Value.

From 2012 to 2024, the MSCI EAFE has had an annualized EPS growth history of 5.9%. By contrast, our current portfolio has an annualized growth history that is more than 100 bps points faster. This growth profile is why we continue to believe the wide valuation spread justifiably deserves to narrow.

CONCLUSION

With 99% active share and our benchmark-agnostic approach, we will occasionally end up offsides, focusing on an area of the market that is unloved. Such was the case in 2024, when our lack of exposure to large-cap stocks and our avoidance of lower quality value companies like large banks hurt our relative performance. In times like these, we focus on what we can control: running our structured research process to identify gems hiding amid the junk.

We believe our fundamental research will pay off in the long run. We expect our portfolio companies will deliver approximately double-digit earnings growth in the years to come. At a P/E of only 10.4x, we are excited about its prospective returns.

We thank you for your confidence, and, as always, we welcome your inquiries.

Dan Kaskawits & John Mullins, Co-Portfolio Managers

|

RISK FACTORS: General: We do not attempt to time the markets or focus on weightings relative to any index. Accordingly, client returns are expected, at certain times, to significantly diverge from those of market indices. Investing in securities involves a risk of loss that investors must be prepared to bear. Because we invest primarily in publicly traded equity securities, Lyrical believes the primary risk of loss is associated with securities selection and broad market movements, and wide and sudden fluctuations in market value can occur. Force Majeure. Lyrical and its clients may be affected by force majeure events (i.e., events beyond the control of the party claiming that the event has occurred, including, but not limited to, acts of God, fire, flood, earthquakes, outbreaks of an infectious disease, pandemic or any other serious public health concern, war, terrorism, labor strikes, major plant breakdowns, pipeline or electricity line ruptures, failure of technology, defective design and construction, accidents, demographic changes, government macroeconomic policies, social instability, etc.). Some force majeure events may adversely affect the ability of a party (including a portfolio company or service provider) to perform its obligations until it is able to remedy the force majeure event. These risks could, among other effects, adversely impact the cash flows available from a portfolio investment, cause personal injury or loss of life, damage property, or instigate disruptions of service. In addition, the cost to a portfolio company or a client of repairing or replacing damaged assets resulting from such force majeure event could be considerable. Force majeure events that are incapable of or are too costly to cure can have a permanently adverse effect on a portfolio company. Certain force majeure events (such as war or an outbreak of an infectious disease) could have a broader negative impact on the world economy and international business activity generally, or in any of the countries in which we invest. International Risks: International holdings involve risks and considerations not typically associated with investing in U.S. companies. The performance of foreign markets does not necessarily track U.S. markets. Foreign investments may be affected favorably or unfavorably by changes in currency rates and exchange control regulations. There may be less publicly available information about a foreign company than about a U.S. company, and foreign companies may not be subject to accounting, auditing and financial reporting standards and requirements comparable to those applicable to U.S. companies. Foreign securities often trade with less frequency and volume than domestic securities and therefore may exhibit less liquidity and greater price volatility than securities of U.S. companies. There may be less governmental supervision of securities markets, brokers, and issuers of securities than in the U.S. Changes in foreign exchange rates will affect the value of those securities, which are denominated or quoted in currencies other than the U.S. dollar. Therefore, for foreign securities which are denominated or quoted in currencies other than the U.S. dollar, there is a risk that the value of such security will decrease due to changes in the relative value of the U.S. dollar and the securities’ underlying foreign currency. Additional costs associated with an investment in foreign securities may include higher custodial fees than those applicable to domestic custodial arrangements, generally higher commission rates on foreign portfolio transactions, and transaction costs of foreign currency conversions. Investments in foreign securities may also be subject to other risks different from those affecting U.S. investments, including local political or economic developments, expropriation or nationalization of assets, restrictions on foreign investment and repatriation of capital, imposition of withholding taxes on dividend or interest payments, currency blockage (which would prevent cash from being brought back to the U.S.), limits on proxy voting and difficulty in enforcing legal rights outside the U.S. Currency exchange rates and regulations may cause fluctuation in the value of foreign securities. In addition, foreign securities and dividends and interest payable on those securities may be subject to foreign taxes, including taxes withheld from payments on those securities. “Fair and balanced” assessment: You are entitled to a fair and balanced presentation, to inform any decision about investing with us. And, no such decision should be based entirely or predominantly on information in this document. By design, our investment approach differs from the norm in important ways. While those differences are intentional and, we believe, well-founded, we allow that those who act more conventionally, too, have reasons for doing so. We strongly encourage that you engage with our client service team to better understand our beliefs and our methods. Questions could be as general as “why value?” or as narrow as “why do you not conviction-weight positions?” for just two examples. Even as our strategies offer liquidity, we seek an alignment of long-term minded investors and our long-term orientation; the better you are informed, the more likely that match will be made. DISCLAIMERS: General: Past performance is not necessarily indicative of future results. Individual results may vary based on timing of investments and/or other factors. There is no guarantee that the investment objective of our strategy will be achieved. This document is confidential and does not convey any offering or the solicitation of any offer to invest in the strategy presented. Any such offering can only be made following a one-on-one presentation, and only to qualified investors in those jurisdictions where permitted by law. The information included in this document is not being provided in a fiduciary capacity, and it is not intended to be, and should not be considered as, impartial advice. “Forward-looking statements” contained herein can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, or assurance or as a representation as to the future. Certain information contained herein has been obtained from third party sources and not independently verified by Lyrical. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information. While such sources are believed to be reliable, Lyrical does not assume any responsibility for the accuracy or completeness of such information. Lyrical does not undertake any obligation to update the information contained herein as of any future date. More complete information about our products and services is contained in our Form ADV, Part 2 Registration with the SEC does not imply a certain level of skill or training. Disclosed holdings: Lyrical disclaims any duty to update historical information included herein, including whether we continue to hold positions that are mentioned. In the interest of our clients, reporting as to positions in transition (being purchased or sold) is lagged at our discretion. Generally, securities which have not been purchased for all accounts are not reflected as held and sales of positions which remain in any client accounts similarly are not reflected. Specific investments described in this document do not represent all investments by Lyrical. You should not assume that investment decisions we include were or will be profitable. Specific investment examples are for illustrative purposes only and not necessarily representative of investments that will be made in the future. A list of all prior investment recommendations is available upon request. Model or hypothetical performance: Where we provide information about performance that is not the actual performance results of our investment strategies (such as where we show the results of price-to-earnings quintiles), please note that there are substantial additional limitations inherent in using such performance information. Those include, but are not limited to, that actual trading and the associated expenses did not occur, that market conditions change over time, and that no investor had the actual performance presented. IMPORTANT NOTES: Index Information: Any indexes and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from those of Lyrical’s strategies. The MSCI EAFE Index is designed to represent the performance of large and mid-cap securities across 21 developed markets, including countries in Europe, Australasia and the Far East, excluding the U.S. and Canada. The Index is available for a number of regions, market segments/sizes and covers approximately 85% of the free float-adjusted market capitalization in each of the 21 countries. The MSCI EAFE Value Index captures large and mid cap securities exhibiting overall value style characteristics across Developed Markets countries around the world, excluding the US and Canada. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield. The MSCI EAFE Equal Weighted Index represents an alternative weighting scheme to its market cap weighted parent index, the MSCI EAFE Index. The index includes the same constituents as its parent (large and mid cap securities from Developed Markets countries* around the world excluding the US and Canada). However, at each quarterly rebalance date, all index constituents are weighted equally, effectively removing the influence of each constituents current price (high or low). Between rebalances, index constituent weightings will fluctuate due to price performance. Indexed EPS The chart on page 6 depicts the historical change of earnings per share of the companies comprising the LAM International portfolio as of December 31, 2024 using current composite share holdings as of that date. The chart on page 3 applies the same methodology to the subset of the LAM International portfolio comprised of European companies. These charts also show the change in earnings per share of the MSCI EAFE Index and MSCI EAFE Value Index over the same period. Earnings per share is computed using consensus earnings data, which include certain adjustments from reported, GAAP earnings. Periods marked with an “E” include estimated earnings per share. LAM International portfolio holdings are included from the earliest date of their available data. Past performance is not necessarily indicative of future results. LAM – International results are unaudited and subject to revision, are for a composite of all accounts. Net returns include a 0.75% base fee and show all periods beginning with the first full month in which the advisor managed its first fee-paying account.  Tagged International Value |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

#Lyrical #Asset #Management #International #Review