By Jiayi Huang and Xiangming Chen

From a battery maker to the world´s leading electric vehicle producer, BYD’s spectacular rise is an eventful journey fueled by dedication, tenacity, and consistent research and development. This analysis of the giant EV auto manufacturer´s success will help growth-oriented companies fine tune their strategy in the age of transition toward green mobility.

The Chinese EV company BYD, headquartered in the high-tech megacity of Shenzhen bordering Hong Kong, has ascended to the pole position in global green mobility. BYD not only overtook Tesla in selling more EVs in 2024 but also beat Tesla by having developed a more advanced charging system that can charge its latest cars in just five minutes to go 400 km (250 miles), relative to Tesla’s Superchargers, which take 15 minutes to add 320 km (200 miles). In addition, BYD offers its proprietary “God’s Eye” driver-assistance system on cars that cost just below $10,000. How did BYD rise so spectacularly to its current position from a budding battery maker in 1994? While much Western media reports on BYD’s rapid growth, we take an in-depth look into the company’s eventful journey and the real sources of its success over the past three decades.

After persistent investment in R&D for nearly 20 years, BYD achieved breakthroughs in key technologies of electric vehicles and took off in the global passenger vehicle market.

Since its founding in 1994, BYD has leveraged three transformative opportunities to develop its core technologies and expand its businesses around the world. The first opportunity was China’s integration into global supply chains after China intensified market reforms in the 1990s. Between 1994 and 2002, BYD developed a cost-effective system to manufacture batteries for top mobile phone companies such as Motorola. The second opportunity that BYD leveraged was the historic growth of China’s automotive market in the 21st century. BYD built a vertically integrated system to mass-produce internal combustion engine (ICE) and new energy vehicles. The third opportunity was the electrification of the global automotive industry in recent years. After persistent investment in R&D for nearly 20 years, BYD achieved breakthroughs in key technologies of electric vehicles and took off in the global passenger vehicle market. BYD’s founding and current president, Wang Chuanfu, acutely identified the three opportunities when they arose.

From 0 To 1: How BYD Established A Firm Footing In The Automotive Industry*

BYD’s rise to a top battery supplier

Wang Chuanfu formally founded BYD by registering it in Shenzhen in February 1995 to leverage opportunities in the battery industry. Wang saw enormous potential in the battery market given the increasing demand for electronic products. Wang was a battery expert when he founded BYD. He moved from Beijing to Shenzhen in 1993 when he was assigned to manage a state-owned enterprise that produced nickel batteries. He discovered that the state-owned enterprise could not keep pace with market changes, so he created his own company. As China’s first special economic zone (SEZ), Shenzhen was a pioneer in China’s market reforms and opening to the world. Financial incentives like lower taxes provided by the Shenzhen government, coupled with bordering Hong Kong, created a favorable environment for entrepreneurially-minded people like Wang to pursue their economic opportunities. Wang obtained financial support from his old friends and several companies to found BYD. BYD started with a team of around 20 employees. BYD exemplified a wave of entrepreneurial start-ups around that time, a number of which later turned into highly successful global companies such as Huawei and Tencent (Chen and Ogan 2017).

BYD created cost-effective ways to produce high-quality nickel and lithium-ion batteries. Whereas its Japanese counterparts used automated processes to make nickel batteries, BYD leveraged abundant labor in China to develop a much cheaper method of production. Wang arranged labor and fixtures in an efficient way that achieved robotic functions. After making breakthroughs in nickel batteries, Wang began studying lithium-ion batteries which were more sophisticated and had a bigger market than nickel batteries. BYD soon became the first Chinese company to mass-produce lithium-ion batteries. Wang decided to target the biggest clients in the battery market so that BYD could learn about the highest standards for quality management. Many multinational companies began outsourcing to China around 2000 allowing BYD to become a supplier to Motorola and Nokia in 2001 and 2002 when BYD also underwent an initial public offering on the Hong Kong Stock Exchange, culminating its achievement as a company focused on producing batteries.

BYD’s great success as a battery maker, more than anything else, stems from Wang Chuanfu being a battery chemist at heart. BYD’s competitors quickly stopped trying to compete with Wang’s battery, which was far superior, and instead used BYD as their supplier. By driving BYD to improve its battery technology, Wang achieved great success in making BYD’s batteries better and cheaper than any competitor (Ogan and Chen 2016). Starting out as a battery manufacturer laid the most logical and sustainable foundation for BYD to enter and thrive in the automotive industry.

BYD’s entry into the automotive industry

After the early success in battery manufacturing, Wang Chuanfu made a bold decision to enter the automotive industry. Wang aimed to enter an industry that was bigger than the consumer battery industry and had connections with batteries. He saw the enormous potential of the Chinese automotive market. In the early 2000s, the Chinese government was reforming the automotive market and encouraging families to buy cars. Most people in China used motorcycles or bicycles for everyday transportation. Wang predicted that a historic number of Chinese people would buy cars over the next decade and that the automotive industry would be more energy-efficient and cleaner, creating opportunities for battery manufacturers. He was confident that BYD could produce high-quality cars at low costs after mastering the core technologies, just like its past experiences in battery manufacturing. BYD obtained the license to produce cars by purchasing the Qinchuan Automobile Company in 2003.

Qinchuan did not have full mastery of automobile technologies so Wang led his team to invent new cars. Although Wang was the most interested in electric vehicles, he understood that the technologies and market for electric vehicles were immature. Inventing ICE vehicles could be a transition and help BYD understand the automotive supply chain. BYD initially wanted to procure parts from external suppliers, but it was difficult to find suitable suppliers. Wang decided to pursue vertical integration. Vertical integration was time-consuming at first but enhanced the efficiency and reduced the costs of R&D in the long term. BYD’s current General Manager of the Branding and Public Relations Division, Li Yunfei, comments, “If you rely on external suppliers, they will not tell you their long-term plan for R&D. They usually provide you with the technologies that are the most profitable for them. Vertical integration helps BYD come up with comprehensive solutions to existing problems in automotive products.” BYD produced its first ICE vehicle model called F3 in 2005 and its first battery electric vehicle (BEV) model e6 in 2009. BYD launched F3DM (DM stands for dual modes) in 2008 and became the first company to sell plug-in hybrid electric vehicles (PHEV) in the world.

BYD started developing electric commercial vehicles in 2008. Wang realized then that it would still take a very long time to electrify passenger vehicles; roadblocks include the lack of the charging infrastructure, consumer distrust in relevant technologies, and the high prices of electric vehicles. But Wang saw at least two benefits of electrifying commercial vehicles. First, electrifying commercial vehicles could act as a buffer zone that educates consumers about electric vehicles. Second, electrifying taxis and buses could significantly reduce air pollution because they accounted for over one-third of air pollution from vehicles. The latter has stayed with Wang as a top consideration in BYD’s relentless pursuit of building more and better EVs as a worthy contribution to the climate cause.

Since 2013 BYD’s electric buses have entered major overseas markets such as the UK, the US, Japan, and India. By 2015, BYD K9 electric buses and e6 electric taxis have spread to over 190 cities in 43 countries and regions. BYD’s buses succeeded in different climates and regulatory contexts. For example, BYD delivered electric double-decker buses to London in the 2010s. In fact, Wang walked side by side with President Xi Jinping of China during the latter’s official visit to the UK in October 2015 when London bought more zero-emission electric buses from BYD (Chen and Ogan 2017). This purchase by a top global city with an iconic bus system went a long way to elevate BYD’s brand and global reputation. It also motivated BYD to solve the technological challenges in transforming the K9 model into a double-decker bus, such as a higher center of gravity and limited space for batteries.

Wang has the deepest understanding of the cutting-edge technologies at BYD. He knows how and when the current bottlenecks will be solved. Solving those bottlenecks will completely transform the customer experience.

BYD established a firm footing in the automotive market and managed to maintain its strategic focus on R&D for electric vehicles despite abrupt changes in market conditions. BYD sold around 400,000 to 500,000 vehicles every year in the 2010s. BYD’s revenue declined in 2012 and 2019, coinciding with fluctuations in the Chinese automotive market. The two troughs pushed BYD to increase the efficiency of its management system. In a system of vertical integration, some BYD factories lacked the motivation to reduce the costs and raise the quality of their products because they were guaranteed that their products could be sold to other factories in BYD. BYD thus made significant changes to its procurement system. It used external suppliers as benchmarks and closed some underperforming factories. Some factories started competing with external suppliers in bidding processes.

The year 2019 turned out to be a very difficult one in BYD’s history. Its net profit for shareholders was only 1.6 billion RMB that year, but Wang Chuanfu still invested 8.4 billion RMB in R&D. Li Yunfei comments, “Wang has the deepest understanding of the cutting-edge technologies at BYD. He knows how and when the current bottlenecks will be solved. Solving those bottlenecks will completely transform the customer experience. His technological expertise has helped BYD to develop a long-term vision and strategy. He is like a prophet and a time traveler. He can maintain his strategic focus and avoid being distracted by fluctuations in external conditions. We firmly believe that our future is bright. We will be lucky if market tailwinds arrive sooner. We are prepared to withstand the difficulties if market tailwinds arrive later.”

Back in 2008, Wang described his three green dreams. The first dream was to develop affordable technologies to use solar energy. The second dream was to help humans store energy. The third dream was to build electric vehicles to reduce air pollution. BYD has invested in R&D for solar cells and energy storage power plants since the 2000s. The three dreams have motivated Wang to expand BYD’s presence in other green industries besides electric vehicles at a global level.

BYD’s Take-Off In The Global Automotive Market

BYD released the revolutionary Blade Battery in March 2020, leading an unprecedented wave of breakthroughs. The Blade Battery is a lithium iron phosphate (LFP) battery for electric vehicles and looks like a blade (Figure 1). The Blade Battery has higher energy density than traditional battery packs and increases the range of electric vehicles, which paved the way for upgrading the Dual Mode (DM) technology platform of hybrid vehicles. The earlier versions of the DM platforms primarily relied on fuel. The DM 4.0 platform, released in June 2020, primarily relied on electricity. BYD released the e-Platform 3.0 for battery electric vehicles in 2021, which Wang Chuanfu called the most essential step from electrifying vehicles to increasing their intelligence. The e-Platform 3.0 was a brand-new platform specifically designed for electric vehicles and integrated the most critical technologies of electric vehicles.

Powered by technological breakthroughs, BYD quickly diversified its vehicle models to meet different demands from consumers. BYD currently has four brands and five sales networks in China. The four brands are BYD, DENZA, FANGCHENGBAO and YANGWANG. The bestselling brand is BYD, which has two sales networks (Dynasty and Ocean). BYD stands for “Build Your Dreams”, symbolizing BYD’s green dreams. In China, vehicle models of the Dynasty network are named after Chinese dynasties (Qin, Han, Tang, Song, Yuan, etc.). The Ocean network looks more youthful than the Dynasty network. DENZA offers a new luxury travel experience. FANGCHENGBAO, meaning “formula leopard” in Chinese, is a professional personalized brand. YANGWANG is a high-end brand. This quartet of brands has provided BYD with a broader and more diversified portfolio of assets.

Wang drives BYD

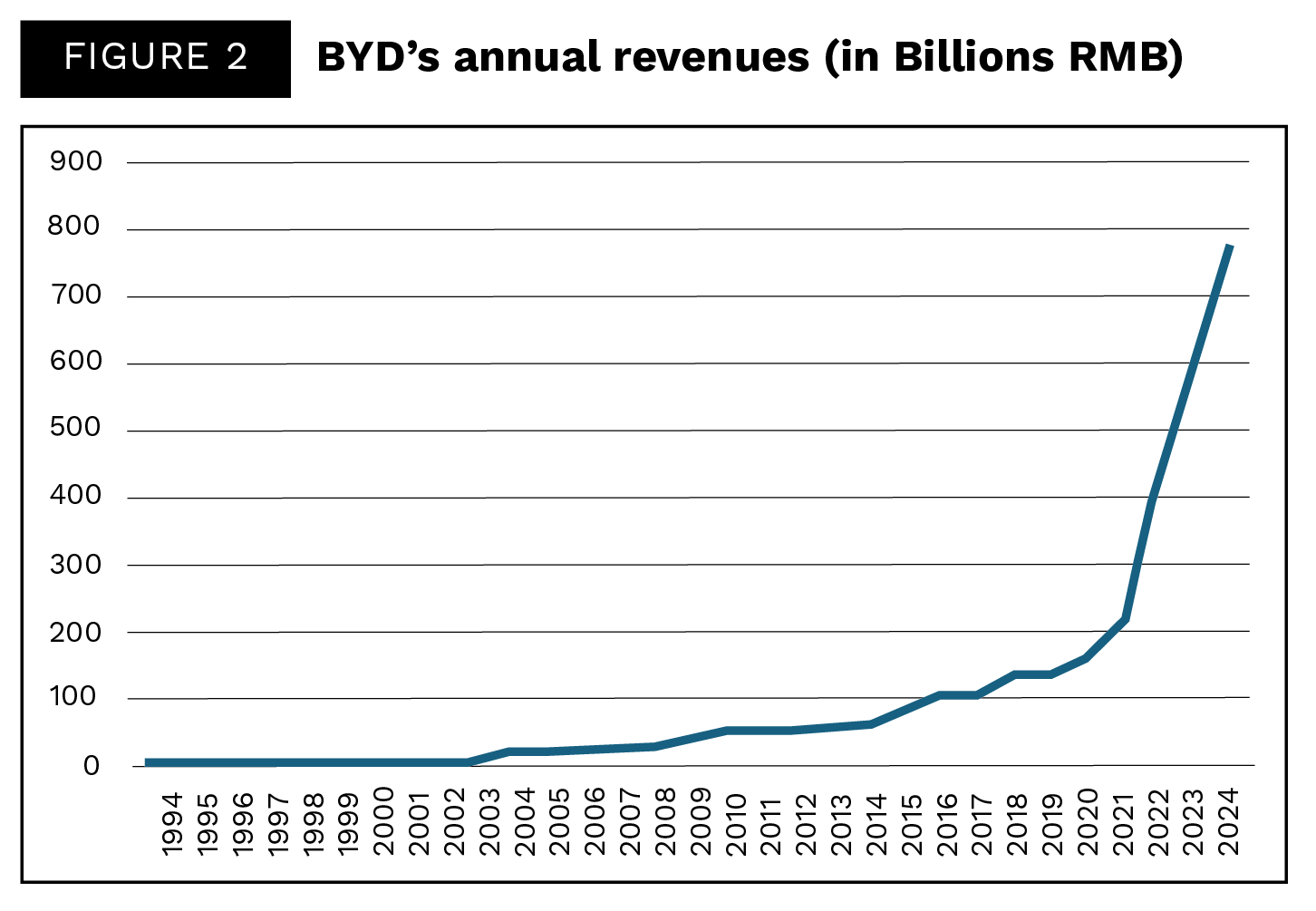

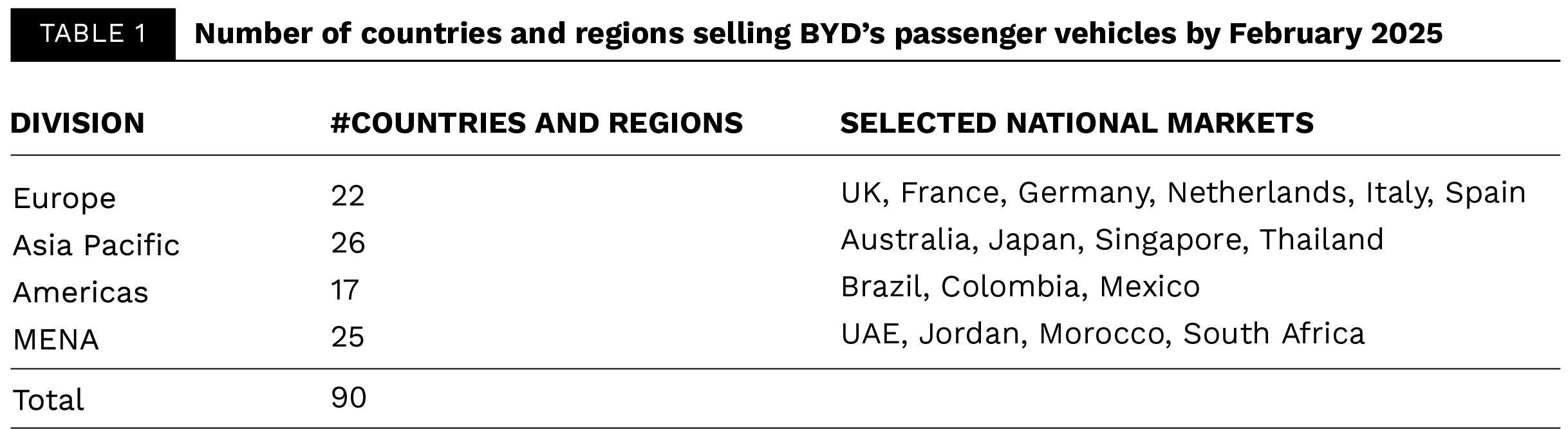

As BYD’s founder but going beyond a conventional founder’s role, Wang Chuanfu has played a pivotal role in shaping and sustaining both the technological core and cultural meanings of the BYD brands. Li Yunfei recalls, “Not everyone in the marketing team is an engineer, but our marketing is driven by a thorough understanding of our technologies. We have launched some pioneer technologies. Many consumers found engineering concepts very boring, so it was challenging to quickly impress our consumers with the strengths of our technologies. Wang was willing to work with the marketing team in the planning stage of marketing campaigns. He was like a professor giving lectures to students. He translated sophisticated technological concepts into plain words. After his lectures, Wang would double check whether we fully understood. He also has great admiration for traditional Chinese culture, which is reflected in the names of our Dynasty models and the logo of our high-end YANGWANG brand. When we started to design YANGWANG’s logo, Wang told us to borrow from the oracle bone script used in ancient China. While some of us proposed using the oracle bone script of ‘electricity’, other proposals went beyond the oracle bone script. Wang ultimately chose our proposal.” Given its thorough understanding of technologies and consumer demands, it was no surprise that BYD’s sales and revenue took off in 2022. Its revenue jumped from 216.1 billion RMB in 2021 to 424.1 billion RMB in 2022, pushing BYD onto the Fortune Global 500 list. Its revenue further rose to 777.1 billion RMB in 2024 (Figure 2). BYD produced its one-millionth new energy vehicle in May 2021 and its ten-millionth new energy vehicle in November 2024. By February 2025, BYD’s passenger vehicles reached 90 countries and regions (Table 1).

Wang’s personal influence is key to BYD’s brisk overseas expansion through a growing and more internationally informed team of senior executives. BYD sold 4.25 million passenger vehicles in 2024, and over 417,000 of those were sold in overseas markets. Since its first overseas office opened in the Netherlands in 1998, BYD has established over 40 branch offices overseas. BYD opened a factory in Thailand last year and is currently completing factories in Brazil and Hungary. Its overseas branches have gained extensive knowledge of local markets by selling batteries and commercial vehicles. Li Yunfei comments, “Many senior executives of our overseas branches have been working in BYD for over 20 years. They are familiar with foreign culture and BYD’s internal organization. They have laid a solid foundation for BYD’s overseas expansion. In addition, we have incorporated overseas talents into our teams.” Regarding Europe, Li adds, “We want to give European consumers more choices, which will benefit them. We have a high respect for automotive brands in Europe and been learning from the European brands. Market competition can motivate everyone to make progress.”

Wang Chuanfu has continued to prioritize innovation through R&D. In 2024, BYD invested 54.2 billion RMB in R&D expenditure, which increased by 35.7% year on year. In March 2025, BYD’s global workforce reached one million, and over 120,000 of those work on R&D. Li Yunfei comments, “A wise leader is essential to a company’s development. A few years ago, my team was planning to build a powerful public image of Wang Chuanfu like other companies but he asked us to stop as soon as he learned about our plan. He said that we should focus on communicating our technologies and products to the public instead of building individual heroism. People that have interacted with Wang have been impressed by his low-key manner. Over 80% of Wang’s meetings focus on technologies and lead to plans for the medium and long terms.”

From a corporate innovator to a global leader

Continued innovation has become the core DNA of BYD, leading to a series of technological breakthroughs in recent years (Figure 3). While recent, these innovations reflect BYD’s persistent and cumulative investments in R&D over the three decades of its rapid growth. BYD’s passion for innovation has been fueled by the larger environment of Shenzhen as its home city that strongly favors corporate innovation and has nurtured several innovative companies like Huawei and DJI in a dense technological ecosystem. Beyond Shenzhen itself, BYD has benefited from competing against many domestic and international automakers in China’s highly competitive EV market irrespective of government subsidies. It is no surprise that these competitive and innovation-conducive local and national environments have fostered BYD’s cumulative success as a leading corporate innovator.

As BYD has innovated from its home base, it has leveraged its innovative capacity in elevating the BYD brand globally and extending its market footprint across nearly 100 countries. Having spanned all segments of the global EV market, BYD has moved up and forward into one of the world’s leading automotive companies, and more importantly, as a pace-setter in green mobility. At a time when geopolitical turmoil has disrupted the global agenda on climate change and energy transition, BYD has proven as a robust and innovative corporate and national leader in pursuing that agenda.

About the Authors

Jiayi Huang is a senior specialist at BYD’s headquarters in Shenzhen. She researches on international political economy and works on overseas public relations for BYD. She holds a Ph.D. in political science from the University of Pennsylvania, a master’s degree in economics from Duke University, and a bachelor’s degree in economics and mathematics from Trinity College in Connecticut.

Jiayi Huang is a senior specialist at BYD’s headquarters in Shenzhen. She researches on international political economy and works on overseas public relations for BYD. She holds a Ph.D. in political science from the University of Pennsylvania, a master’s degree in economics from Duke University, and a bachelor’s degree in economics and mathematics from Trinity College in Connecticut.

Xiangming Chen is Paul E. Raether Distinguished Professor of Global Urban Studies and Sociology at Trinity College in Connecticut and an Associate Fellow at the Center for Advanced Security, Strategic and Integration Studies (CASSIS) at the University of Bonn, Germany. He has published extensively on urbanization and globalization with a focus on China and Asia as well as a frequent contributor on “China in the World” to The European Financial Review and The World Financial Review. He has also conducted policy research for the World Bank, the Asian Development Bank, UNCTAD, and OECD.

Xiangming Chen is Paul E. Raether Distinguished Professor of Global Urban Studies and Sociology at Trinity College in Connecticut and an Associate Fellow at the Center for Advanced Security, Strategic and Integration Studies (CASSIS) at the University of Bonn, Germany. He has published extensively on urbanization and globalization with a focus on China and Asia as well as a frequent contributor on “China in the World” to The European Financial Review and The World Financial Review. He has also conducted policy research for the World Bank, the Asian Development Bank, UNCTAD, and OECD.

Footnote

- The first two sections draw heavily from the Chinese book The Soul of Engineers, which BYD recognizes as its official history. This article including its illustrations also draws from other material and information compiled by BYD unless otherwise noted. The interview with Li Yunfei was conducted in March 2025 specifically for this article.

References

- Xiangming Chen and Taylor Lynch Ogan (2017). China’s Emerging Silicon Valley: How and Why Has Shenzhen Become a Global Innovation Center. The European Financial Review, December/January p. 55-62.

- Taylor Lynch Ogan and Xiangming Chen (2016) The Rise of Shenzhen and BYD—How a Chinese Corporate Pioneer is Leading Greener and More Sustainable Transportation and Urban Development. The European Financial Review, Feb/March p. 32-39.

- Shuo Qin and Yuejia Xiong (2024) The Soul of Engineers: BYD’s Rise During 1994-2024 (in Chinese). (Beijing: The CITIC Publisher).

#Global #Leader #BYDs #Rapid #Ascent