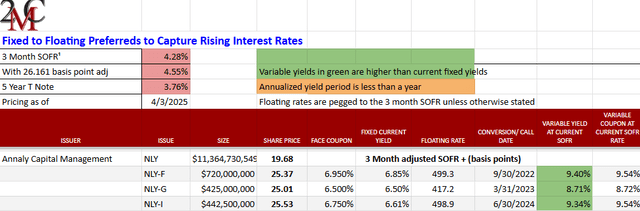

Floating rate preferreds are subject to a phenomenon of timing, which is making them interesting yield plays and potentially opportunistic. Many of these issues were created in a very different environment, and now that the environment has shifted, they are yielding somewhere around 10%. A yield that was never intended, but is available today due to the timing phenomenon.

The Timing Phenomenon

Many preferred issues were incepted around 4 to 7 years ago during the zero interest rate period. At that time, they were an instrument that allowed REITs to raise permanent capital at cheap interest rates.

Many preferreds were issued with coupons in the mid 6% range and they were structured in such a way as to convert to floating rate 5 years after issuance. The floating rate was intended to be approximately equal to the face coupon, but that has proven to be a naïve assumption.

These instruments were initially written using LIBOR (London Interbank Offered Rate) as the floating rate. They have since changed to SOFR (Secured Overnight Financing Rate).

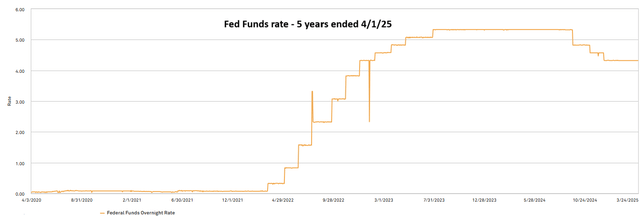

SOFR was not really around 5 years ago and LIBOR is largely cancelled today, so we can’t cleanly graph either term on a 5 year chart. Instead, we can graph the Fed Funds rate over 5 years which is largely similar to either of these terms.

S&P Global Market Intelligence

So, as seen above, when these preferreds were underwritten, SOFR was essentially 0. So when an issue like AGNC Preferred E (AGNCO) was underwritten with a variable coupon of SOFR + 499.3 basis points it was supposed to be a step down in yield upon converting to floating. That would have been in the low 5% range compared to the fixed rate coupon of 6.5% for the first 5 years of the issue.

The higher fixed coupon for the first 5 years was intended to draw in investors. 6.5%, in a zero-rate environment, was a great yield.

Well, then the yield curve changed.

SOFR has since moved much higher and rests today at 4.28%. So this issue, which converted to floating rate in October of 2024, now yields 9.51%

Portfolio Income Solutions

AGNCO is just one of many issues underwritten 4 to 7 years ago that now has a very oversized yield due to a floating rate feature.

In analyzing these issues, there are quite a few factors to which one should pay attention.

- Stability of underlying company

- Size of preferred issue relative to common equity underneath it

- Discount or premium to par value

- Adjustment above SOFR

These help to estimate the potential return on the issue relative to overall risk.

Returning to AGNCO, it is among the more stable underlying companies, as AGNC Investment (AGNC) is large with over $8B of equity underneath the preferreds and deals primarily in government backed securities. The issue is redeemable at any time for $25 plus accrued dividend, which limits its ability to trade significantly above par.

It is freshly ex-dividend (April 1st) so there is not really a partial period to factor into par value. Thus, at $25.07 one is paying a few pennies over what it would potentially be redeemed for. As such, there is essentially zero capital gains potential here. One would just buy and hold it for the dividend.

Overall, it is reasonably attractive. A 9.51% yield is very high for what seems to be a below average risk preferred due to the aforementioned company stability factors.

AGNCP is also potentially interesting as it converts to floating rate on 4/15/25 at which point it will pay SOFR plus 469.7 basis points. At the pricing in the above screenshot, AGNCO is fractionally better, in my opinion, but not a large enough gap to arbitrage.

Preferreds in general are thinly traded so the prices often move around in irrational ways. We find it quite worthwhile to watch issues like this as there will frequently be times in which one of the issues gets substantially more opportunistic than the pari-passu preferreds of the same issuer.

There are 2 types of preferred opportunities in today’s market that I want to discuss.

- Those similar to AGNCO where there is not much in the way of capital appreciation potential but the yield is just huge.

- Those significantly discounted to par affording substantial capital gains potential in addition to the yield

Big dividends

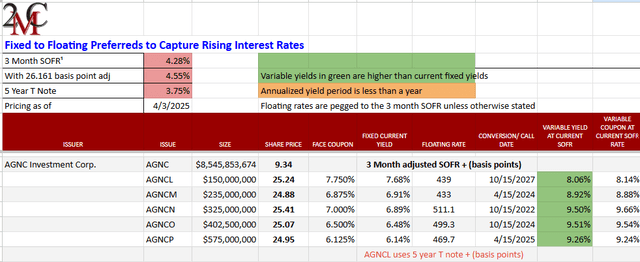

Dynex Capital (DX) is a hybrid mREIT investing in both agency and non-agency mortgage backed securities. It is medium size at over $1B in common equity and the preferred, (DX-C) is nicely cushioned at less than 1/10th the size of the common.

The face coupon of DX-C is just 6.9%, but it converts to floating rate of SOFR plus 546.1 basis points on 4/15/25.

Portfolio Income Solutions

That will take its yield to 9.89% at current market pricing.

DX-C is trading slightly above par which does create a few pennies of redemption risk. Otherwise, it is just a very large yield and the common stock has been performing well which somewhat reduces risk level.

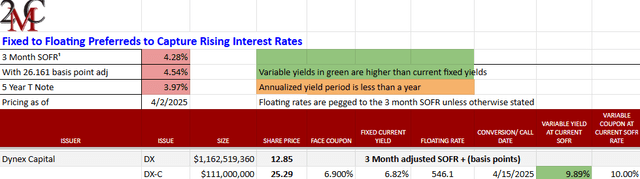

Annaly Capital Management (NLY) is large and arguably has the best protected mREIT preferreds in terms of common cushion and business stability.

Portfolio Income Solutions

The yields here, particularly on (NLY-F) and (NLY-I) are quite attractive, but I would caution that the premium to par is enough that redemption poses a real risk. I would personally not want to buy these until they are at $25.00 or below.

Capital appreciation potential plus big dividends

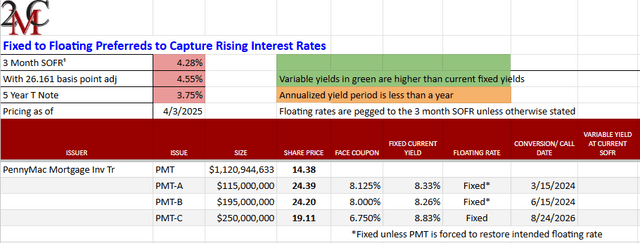

PennyMac Mortgage Trust (PMT) is in a rather interesting scenario as one of very few companies that chose not to honor the floating rate provision on its fixed-to-floating preferreds. As its series A and B preferreds (PMT-A) and (PMT-B) converted to floating on 3/15/24 and 6/15/24, respectively, PMT argued that with no perfect replacement for LIBOR it was just going to keep them at the same fixed rate of the first 5 years of these issues.

PMT preferred C (PMT-C) is supposed to float on 8/24/26, but our base case is they will use the other preferreds as precedence and keep that fixed as well. As such, the yields on these preferreds look like this:

Portfolio Income Solutions

The market has deemed mid 8% to be the appropriate current yield for these issues and trades them there regardless of coupon. This creates an interesting rift in valuation where PMT-C with its lower coupon trades at a massive discount to par while the others are within spitting distance of par.

The divergent pricing makes PMT-C not only have higher current yield at 8.83%, but substantially more capital appreciation potential. In my opinion, it is much better positioned than the A or B series.

Perhaps the reason the market is chasing the A and B to current yields below that of C is that some believe PMT will be forced to honor the original floating rate. If that happens, PMT may be forced to pay back dividends equal to the difference on the A and B issues starting at the time they were supposed to float.

Since PMT-C is not yet floating, it would not have this same accrual.

I still find PMT-C to be more opportunistic as the above event would likely mean that PMT-C would properly float at its conversion date so the issue would likely trade much closer to par, allowing those who buy at these discounts to get substantial capital appreciation.

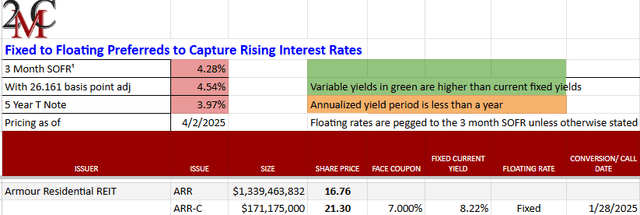

Armour Residential (ARR) preferred C (ARR-C) is just a straight fixed rate preferred with a 7% coupon, but is made interesting by the discount at which it trades.

Portfolio Income Solutions

The $21.30 market price makes the 7% coupon into an 8.22% current yield which alone is solid. I think the real potential here is the capital appreciation that could happen if interest rates drop.

Since the tariff announcement, the entire yield curve has been soft with the 10-year Treasury dropping back down to close to 4%. In a lower interest rate environment this fixed coupon gets increasingly attractive so I would anticipate it to trade up closer to par.

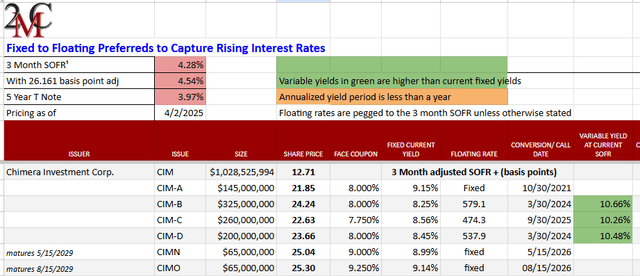

Chimera (CIM) preferreds are freshly discounted. For a while they were just yield plays like AGNCO or DX-C, but in recent weeks their market prices dipped.

Portfolio Income Solutions

I haven’t been able to identify any fundamental problems that would have caused the dip, so I suspect it is just erratic trading in low liquidity issues. We frequently spot unusual price fluctuation in low liquidity preferreds both up and down. Often it is related to an individual holder needing to sell or wanting to get in and not being patient enough to use limit orders.

At these lower prices, the CIM preferreds offer both substantial current yields and capital appreciation potential which we believe is opportunistic relative to the moderate risk level.

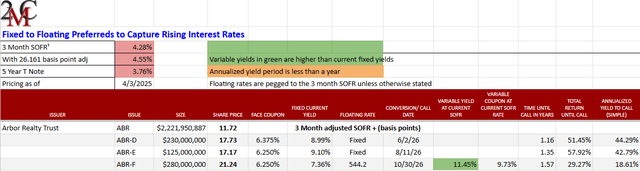

Moving a little bit further out on the risk spectrum we have Arbor Realty (ABR). ABR’s apartment construction loans originated around 2021 are indeed struggling. The surge in interest rates caused a substantial portion of these loans to go underwater and ABR has taken impairments for these losses.

However, 2 factors are likely to help ABR recover some of the losses:

- Apartment absorption has been much better than anticipated, increasing the value of the collateral

- Interest rates have come back down a fair amount.

Overall, ABR will experience some losses, but their general business is largely fine and the common equity is large enough to fully absorb these losses. As such, we believe the preferred liquidation preference will be untouched and ABR is positioned to be able to continuously pay preferred dividends.

These preferreds trade at huge discounts to par.

Portfolio Income Solutions

The F series (ABR-F) floats on 10/30/26 at which point the yield goes to SOFR + 544.2 basis points. Even if interest rates do fall that is likely a huge yield.

Series D (ABR-D) and E (ABR-E) are both fixed rate with fairly low coupons of 6.375% and 6.25%, respectively. However, because of how discounted they are trading the current yields are 8.99% and 9.10%, respectively.

I think the yields on these in combination with the capital appreciation potential make them quite attractive relative to the risk. I view these as slightly above average risk and believe the market is mistaken in labeling them as extreme risk.

The damage done to ABR was event driven while its fundamentals have otherwise substantially outperformed the rest of the mREIT sector. The development and interest rate event which precipitated the underwater loans is approaching resolution at which point I think the market will see ABR as more stable and trade the preferreds closer to par.

Overall opportunity and risk

These preferreds were issued with intent to have variable yields around 5%-8% but because of the change to the interest rate environment they are now yielding 8.5%-11%. These yields provide market beating income potential while many of these issues also have potential capital gains as well.

Risk factors to consider:

Rapid fluctuations in yield curve such as steepenings or flattenings can occasionally get around mREIT hedging activity and hurt book value. Modest book value declines over decades are largely expected for mREITs which pay out essentially all of their earnings as dividends. Such orderly declines do not threaten preferreds due to seniority in the capital stack, but sudden shocks might. Investors in preferreds may be wise to watch for sudden shocks.

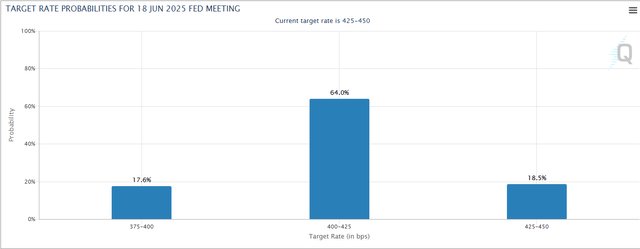

Floating rate preferred dividends can go up or down with SOFR and it is currently expected that the Fed will be cutting in June.

CME Group

SOFR tends to move in parallel with Fed Funds, so if this cut manifests, the yield would be 25 basis points lower than current.

#Floating #Preferreds #Monstrous #Yields #Due #Timing #Phenomenon