Orbon Alija/E+ via Getty Images

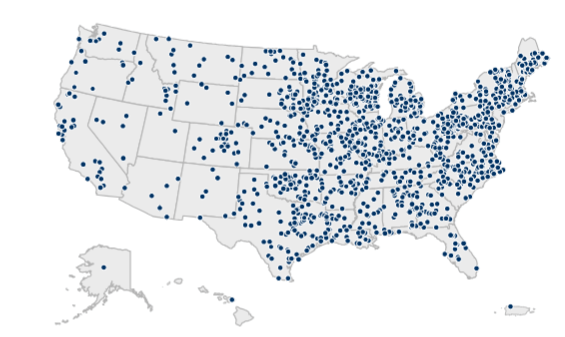

Postal Realty (NYSE:PSTL), despite being a small cap, is by far the market share leader in the post office real estate niche. The company owns over 1600 post office buildings and leases them to the USPS over 5-year or 10-year terms.

This article will discuss Postal’s fundamental outlook along with management, valuation and risk factors.

Properties and historical leasing

Most REITs with over 1600 properties would be mid-caps or even large caps, but Post Offices are much smaller properties often acquired by PSTL for under $1 million.

These properties are scattered throughout the U.S. in large cities as well as very small towns because that is the nature of the USPS logistics network. One of the core functions of the USPS is to ensure anyone can have access to mail, regardless of where they live.

PSTL

The properties are functional in nature, which allows them to forego the expensive facelifts that other types of real estate endure. Recurring capex for PSTL is most recently cycling at $253,000 quarterly or about 1.3% of revenues, which is toward the low end of REITs.

Post offices are very high occupancy and have retention around 99%. This is largely the result of USPS having a consistent mandate in which they continuously provide service to the same locations.

92 million square feet of post offices are privately owned and within that, it is highly fragmented. PSTL is by far the single biggest player, owning 6.2 million square feet with the rest overwhelmingly spread amongst Mom-and-Pop owners. Being the biggest player in the industry allows PSTL to enjoy certain benefits of scale, such as negotiating power and inbound requests. When other parties look to sell post offices, they know PSTL is the primary aggregator which can facilitate off-market transactions. PSTL has also received inbound requests to buy some of their properties, which enabled recent sales at accretively low cap rates.

Overall, post offices are a steady income sort of asset class with reliable rent collection.

Growth outlook

Postal Realty has 3 main sources of growth:

- Organic rental rate growth

- Acquisition spreads

- Refinancing (negative or positive)

In the discussion below, we will dig into each of these categories to approximate an overall forward growth rate for PSTL.

Organic rental rate growth is the most straightforward. Leasing activity formerly consisted of flat 5-year leases, in which a new lease rate would be negotiated at the expiry of each 5-year period. In recent negotiation rounds, however, PSTL was able to achieve 2 shifts in leasing practices.

- Lease terms are now often signed at 10-year lengths

- Escalators of about 3% have been added

These additions are arguably mutually beneficial to both sides, as the main difference is that they add certainty and stability. USPS likely already plans to stay in these properties for a long time, so more clarity on that outlook benefits them, while longer lease terms allow the REIT to better forecast future revenue.

3% escalators are nice, but they don’t really change the organic growth rate because in historical negotiations PSTL was already getting rent bumps that equated to just over 3% annually. So basically, it has shifted to contractual annual step-ups with smaller jumps on renewal, as opposed to the former flat leases with large bumps on renewal.

Either way, organic rental rate growth is a little bit over 3% annually. With longer lease terms and escalators, investors just get more visibility into the outlook.

Acquisition spreads

External growth is less predictable because it depends on factors outside the company’s control, such as share price and prevailing market cap rates.

We will attempt to calculate current spreads below, but note that acquisition spreads are subject to change with various market forces.

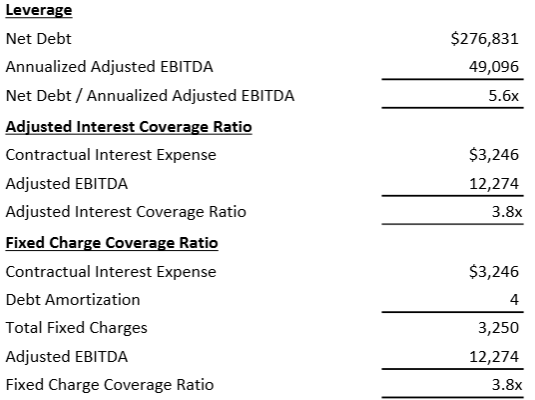

Postal’s cost of existing debt is just under 5% and given their normal leverage we think new issuance would be at about 5%. Debt to EBITDA of 5.6X and fixed charge coverage of 3.8X are healthy and in the normal range for REITs.

Supplemental

Cost of equity is of course dependent on the market price of the stock. 2025 AFFO is estimated at $1.07 which at the current price of $13.95 per share would be a cost of equity capital of 7.6%.

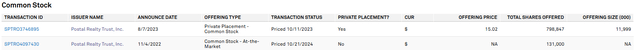

Note that PSTL has generally held off on issuance until high $14s or higher, with a 2023 offering at $15.02.

S&P Global Market Intelligence

Robert Klein on the 3Q24 call detailed their equity issuance in 2024:

“During the third quarter and through October 21, we issued approximately 732,000 shares of common stock through our ATM offering program and 252,000 common units in our operating partnership for total gross proceeds of approximately $14.2 million at an average gross price of $14.41.”

At $15.02 and $14.41, that would be a cost of equity capital of 7.1% and 7.4%, respectively.

PSTL’s capital structure is about 60% equity, so leverage neutral investment would be at a 60/40 equity to debt ratio, which puts overall WACC at about 6.44%.

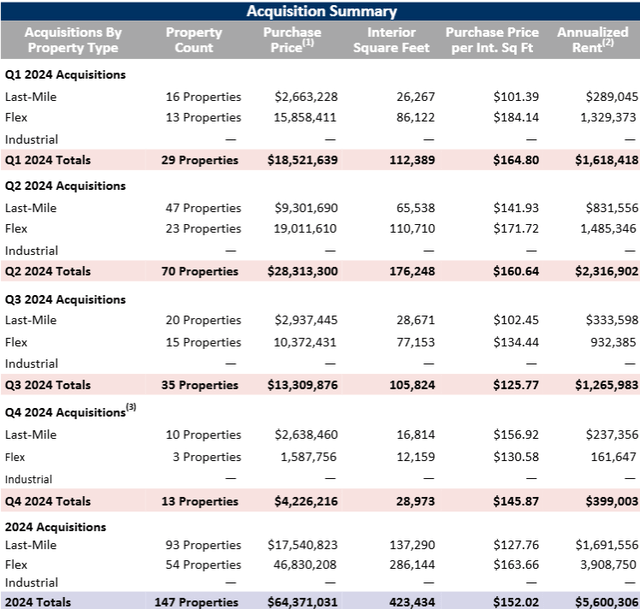

Its acquisitions are tabulated below.

PSTL

Based on the rent and cost paid, that is an 8.7% revenue cap rate.

There are expenses to consider here such as real estate taxes and opex, so the NOI cap rate would be lower. On the 3Q call, CEO Andrew Spodek spotted their weighted average cap rate at 7.5%.

“Through October 21, we have completed $64 million in acquisitions for the year and have placed an additional 29 properties totaling $11 million under definitive contracts. While acquisition volume was a bit lighter during the third quarter, we are still targeting $90 million at or above a 7.5% weighted average cap rate for 2024.”

A 7.5% ROIC against a 6.44% WACC suggests acquisitions have been accretive at a going in spread of about 1 percentage point.

$90 million acquisition volume for 2024 at a 1 percent spread is an incremental AFFO of $0.9 million, or about 4 cents per share. Cost of debt appears to be dropping slightly, while PSTL’s market price has also dipped slightly. The combined effect should be a similar WACC, so I think spreads will remain around 100 basis points in the near future.

Refinancing growth or negative growth

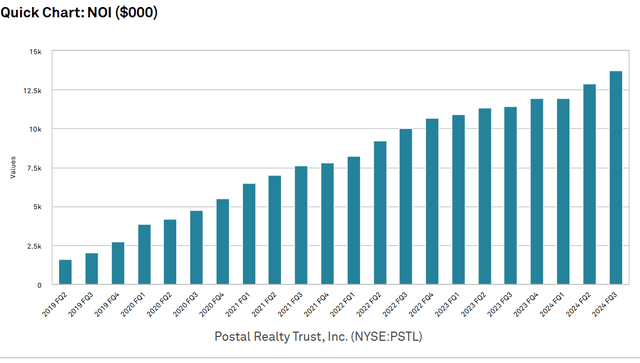

As it has grown its property base, NOI has grown nicely.

S&P Global Market Intelligence

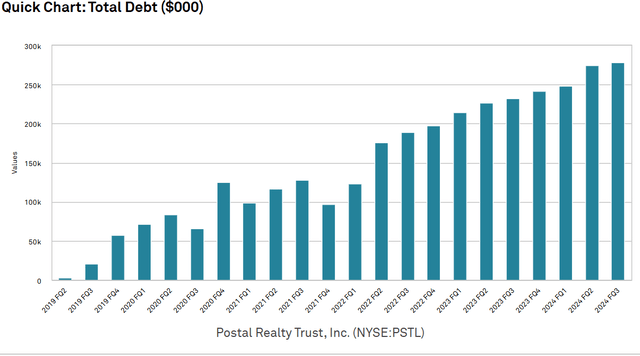

Postal has kept a relatively constant ~40% debt capital structure, so its debt has grown proportionally.

S&P Global Market Intelligence

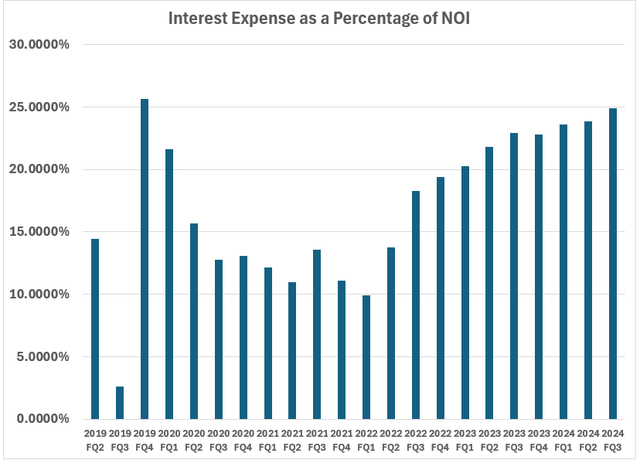

While nothing has changed with the capital structure within the company, the macro environment changed considerably, with interest rates going from near 0 to the Fed Funds rate shooting to over 5% in 2022-2023.

Some of PSTL’s debt had to be refinanced at higher rates, which brought its weighted average cost of debt up. As such, interest expense as a percentage of NOI has risen to 25%.

2MC using data from company filings and S&P Global Market Intelligence

Higher interest expense manifested in negative growth from refinancing.

To summarize PSTL’s growth drivers:

- Organic rental rate growth – ~3.5% annually.

- Acquisition spreads ~3%-4% annually.

- Refinancing – significantly negative in 2022, 2023 and 2024.

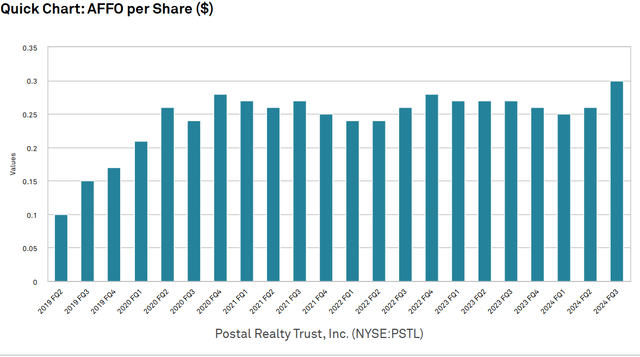

As a result, PSTL’s AFFO/share has looked like this:

S&P Global Market Intelligence

AFFO/share has been roughly flat for the last few years. Higher interest expense has offset their other growth drivers.

Going forward, however, interest expense is stabilizing with potential for a slight decrease. PSTL’s cost of debt has fully adjusted to the current environment and interest rates are broadly believed to be headed down, albeit slightly, with only one more Fed cut anticipated in the near term.

As such, refinancing growth should be roughly flat, allowing rental rate and external growth to show through. We calculate Postal’s overall AFFO/share growth rate going forward at about 6%.

Management assessment

We have followed PSTL since shortly after its IPO and have owned shares for much of that duration. It has been a mediocre holding, with the share price not going anywhere for many years, but the high dividend yield (about 7%) has made the total return moderate.

Total return track record is part of assessing management, but far from the entire process as it includes many things that management cannot control such as share price movement and the environment.

The rest consists of judging the character of management and the decisions they have made. We met with management many times over the years and subjectively assessed them as trustworthy. The things they told us matched with what they say publicly, and more importantly, matched with what they did. PSTL stated their plans to grow within the postal real estate niche, and they have done so with moderate acquisition volume as opportunities permitted.

PSTL

Timing of equity issuance has consistently made sense, with shares issued at prices where acquisitions at their typical cap rates would be accretive.

Property level performance has been in line with expectations – steady rental rate growth with essentially full occupancy (most recent quarter at 99.6%). Thus, their property selection and relations with tenants seem appropriate.

AFFO per share growth has been disappointing, but as discussed earlier, that appears to be consequent to the environment with the Fed Funds rate rising over 500 basis points.

Interest rates remaining moderate to high is not a headwind going forward. It was the delta in rates that hurt AFFO/share. That offsetting factor to growth was entirely out of the company’s control. Its capital structure was appropriate, with consistently strong coverage ratios.

Overall, we rate Postal’s management favorably and will be monitoring to see that they can, in fact, convert the now significantly more favorable environment into significant AFFO/share growth. Based on our estimates, they should be able to achieve a baseline of 6% annual growth going forward.

Valuation

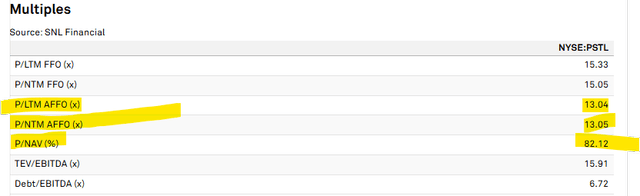

Consensus AFFO implies a 13X multiple.

S&P Global Market Intelligence

Given where the rest of the market and REITs trade, a 13X multiple implies slow growth of roughly 2% annually.

Postal appears to be priced in line with its backward-looking growth rate.

As discussed earlier, we see growth inflecting upward with the cessation of rapidly rising interest rates. If PSTL’s growth can indeed improve to closer to 6% annually, we believe it is significantly undervalued.

6% growth rate should be valued at closer to 17X-18X AFFO.

Net asset value backs up the idea of undervaluation, with the company trading at 82% of NAV.

Risks to company

Tenant concentration is PSTL’s most prominent risk. The USPS has been an extremely steady and reliable tenant, and I don’t see an imminent reason that would change, but the future is unknown. Perhaps something could profoundly change its logistics network such that fewer branches are needed. There is also continual talk of overhauling or privatizing the USPS, which could potentially change the way they interact with real estate.

This risk can be partially mitigated by portfolio diversification. PSTL is the only company in our portfolios that has meaningful exposure to USPS such that it becomes an idiosyncratic risk rather than systemic. Regardless, PSTL as an individual stock would likely be hurt if something bad happens to USPS.

#Postal #Realty #Returns #Growth #Interest #Expense #Normalizes #NYSEPSTL