Greggory DiSalvo/iStock via Getty Images

Realty Income (NYSE:O) is famous for its dividend. It is known as the Monthly Dividend Company and has raised its dividend for 110 consecutive quarters. This reputation had 2 key impacts:

- A loyal investor base, providing O with a cheap cost of equity capital.

- Pressure to maintain the streak of dividend raises.

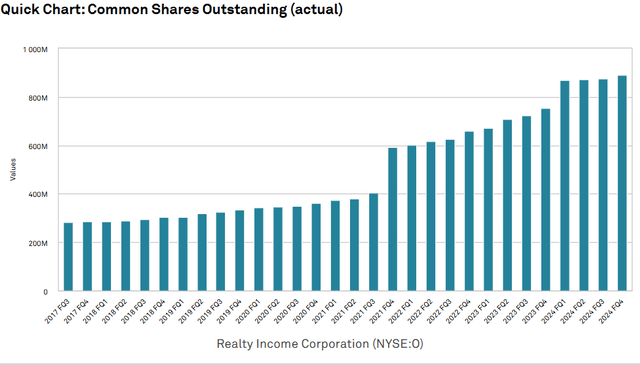

The first has undoubtedly been beneficial to the company. O’s equity has served as excellent currency, allowing them to issue shares and buy new assets at large spreads. The company correctly used its high AFFO multiple and premium to NAV to issue extraordinary amounts of equity. Share count has tripled in the last 7 years.

S&P Global Market Intelligence

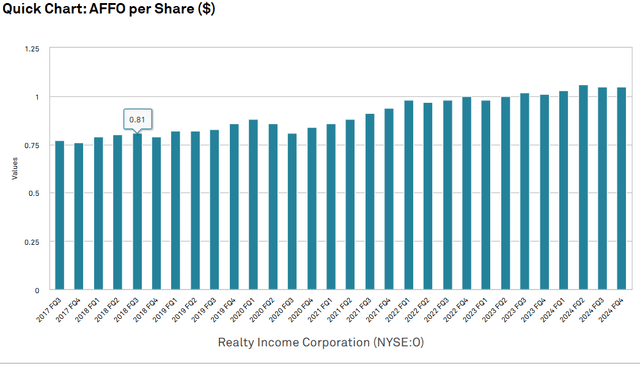

Due to the high AFFO multiple at which the equity was issued, these purchases were accretive and AFFO/share grew nicely.

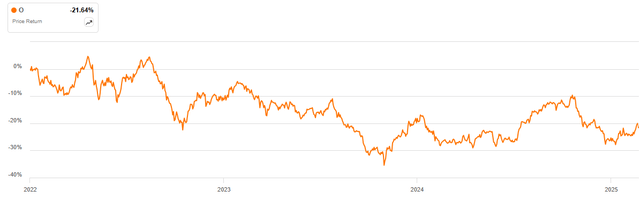

Market prices, however, are fickle. An extremely reliable dividend such as the one O promises is less desirable to the market when treasuries can essentially guarantee an investor almost 5% yields. It turns out, fewer people want a dividend with equity risk when a similarly sized dividend is backed by the U.S. government.

The surge in treasury yields took down just about every dividend stock, but it particularly hurt the market price of O because of its reputation as a dividend focused company.

SA

This created a bit of a challenge for O. They still had to maintain their streak of dividend increases, but no longer had overpriced stock to use as currency.

Issuing equity at today’s 13.15X AFFO multiple is much harder to make accretive than their former 18X multiple (cost of equity capital increased to 7.6%).

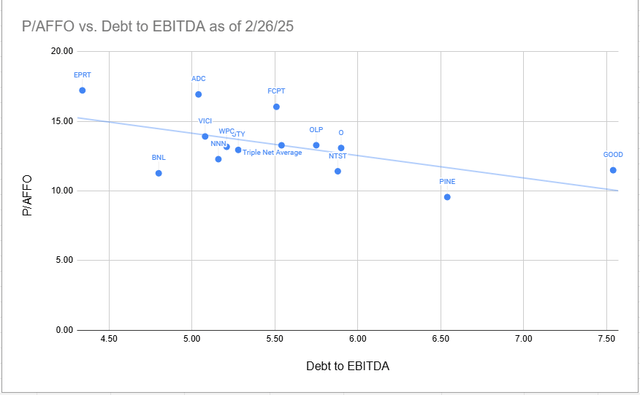

This problem is not unique to O. REITs in general have become discounted to fair value, and O sits in the middle of triple nets with regard to leverage adjusted valuation.

Portfolio Income Solutions

The problem that is unique to O is its need to keep that dividend streak going.

Capital allocation for a REIT is a fine science, requiring different approaches to different scenarios. In market environments where equity is flowing, O’s perennial strategy of issuing equity to buy billions of dollars of assets is the correct approach.

However, in more hostile market environments, such as the one from 2022-2024 for REITs, a different approach is advisable. Cap rates available on acquisitions remained somewhat low despite the cost of capital being higher, which made spreads less favorable to REITs in the 2022-2024 window.

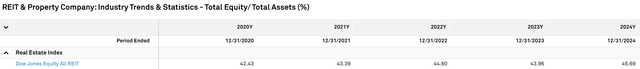

As such, it was not a time to be trying to grow rapidly. Most REITs chose to hunker down and focus on quality of properties and balance sheet. REITs broadly reduced leverage, with equity as a percentage of assets increasing to 45.69%.

S&P Global Market Intelligence

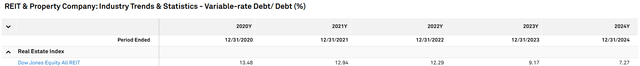

REITs also paid off or refinanced variable rate debt, bringing variable rate debt down to 7.27% of overall debt.

S&P Global Market Intelligence

Peer triple net REITs really focused on quality of properties.

W. P. Carey (WPC) got rid of essentially all of its office assets, leaving a much leaner portfolio of industrial and retail.

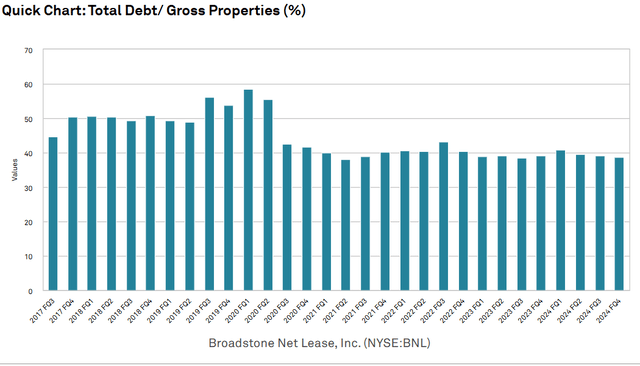

Broadstone Net Lease (BNL) similarly sold off its office and medical assets to also arrive at a higher organic growth portfolio. BNL also used the time period to substantially reduce leverage.

S&P Global Market Intelligence

I believe that is correct capital allocation. When the environment is making external growth less favorable, it is wise to focus on quality improvement rather than continuing to buy assets at tiny spreads.

This is where it would seem O was disadvantaged by its mandate. 100+ consecutive quarters of dividend growth is an impressive streak, and it would be a shame to lose it. So the company had to keep raising its dividend and in order to do that responsibly, it needed to keep growing AFFO/share.

AFFO/share growth is generally a good goal for a REIT to have, but it causes problems when it is pursued at the expense of quality. Sometimes it is correct for a REIT to take a hit to AFFO/share, as WPC did so as to drastically improve quality.

With its mandate to keep raising the dividend, O did not seem to feel like they had the freedom to focus on the long term, instead making numerous decisions to bolster near term AFFO/share. In that sense, they succeeded, as AFFO/share grew nicely even through the doldrums of 2022-2024.

S&P Global Market Intelligence

But it came at a huge cost. Quality has degraded substantially, and cracks are starting to show in a material way.

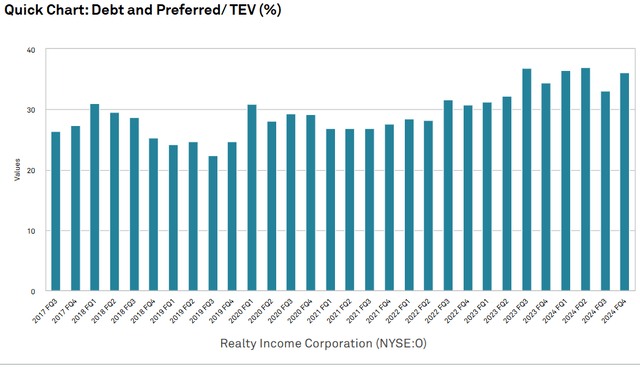

Unlike peers who used the doldrums to reduce leverage, O kept buying assets and when equity ran dry, they bought with debt, resulting in higher leverage.

S&P Global Market Intelligence

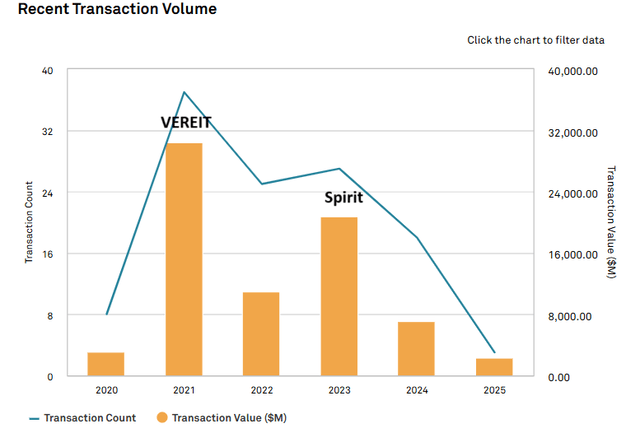

O was buying single assets as well as entire companies. Their recent transactions are summarized in the graph below.

S&P Global Market Intelligence

Both VEREIT and Spirit had some junky assets in their portfolios. The 2021 VEREIT purchase was a good decision, in my opinion, because O had such a high stock price at the time that the magnitude of AFFO/share accretion made it worth taking on some junky properties.

By 2023, however, O’s stock price had declined considerably, making the Spirit purchase much less accretive and, in my opinion, not worth taking on the junky properties.

Quality deterioration

At the surface level, it is not easy to spot the quality deterioration. Headline numbers look really good as per their Q4’24 earnings presentation:

Occupancy at year-end was 98.7%. For the year, rent recapture across 833 renewed leases was 105.6%.

Leasing spreads of +5.6% is reasonably good for a triple net, and 98.7% occupancy is solid.

What is missing from these numbers is what happens to the leases that are NOT renewed.

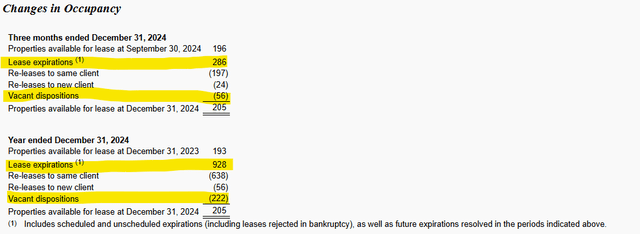

Earnings Release

Of the 928 leases that expired in 2024, 638 were re-leased to the same tenant. 56 were leased to new tenants.

The remaining 234 went vacant. That is vacancy on 25% of expiring leases.

So how is occupancy still 98.7%?

Well, O sold 222 vacant properties in 2024 and once a property is sold it is no longer counted as vacant. The sale of vacancy seems to be accelerating with a substantial number sold in the 4th quarter, per Sumit Roy’s (O’s CEO) commentary on the earnings call:

To that end, in the fourth quarter, we sold 80 properties for total net proceeds of $138 million of which $50 million was related to vacant properties.

Selling vacant assets is an entirely normal thing for a triple net REIT to do. The problem here is just how many vacant assets they had.

We believe more vacancies are on the horizon with a slew of troubled tenants:

On the same Q4’24 earnings call, Sumit Roy discussed their increased provision for credit loss:

Our forecast includes a provision for 75 basis points of potential rent loss as well as an impact from the move out of a large office tenant.

Beyond the troubled office, O gets a significant portion of its revenues from troubled retailers.

- Walgreens – 3.3%

- CVS – 1.2%

- AMC 1.1%

Putting it into context

Triple nets naturally grow over time from escalators built into their leases and rolling rental rates up upon renewal.

These gradual gains are offset by property failures such as tenant bankruptcy or failure to find a new tenant upon lease expiry. Most triple nets are highly diversified, with thousands of individual properties and vast tenant rosters.

In any given year, a few of the properties will almost always fail, yet the net impact should be positive because the escalators on the overwhelming majority of succeeding properties outweigh the few that fail. As such, the organic growth rate of a triple net REIT is largely determined by the portion of their properties that are succeeding relative to the vacancies.

O, due to its aggressive pursuit of near-term AFFO in the form of buying portfolios, including junky properties, has set itself up to have a higher portion of its assets struggling. We showed the 25% vacancy on expiring leases and the multitude of currently troubled tenants.

With a higher internal property failure rate, O’s organic growth is likely to lag behind that of peer triple nets.

In contrast, BNL and WPC sacrificed some short-term growth in 2022 through 2024 by disposing of weakness and shoring up their balance sheets. Getting rid of weak assets is almost always dilutive in the near term because weak properties or properties with weak tenants sell at high cap rates, making it a negative spread initially. However, this sort of quality enhancement improves long-term growth rates. This will show up as leases roll over. A higher percentage of tenants will renew, and rent roll-ups are likely to be larger. They have positioned themselves for stronger forward organic growth.

O’s myopic focus on immediate term AFFO/share shows up in the way they look at acquisitions. Much of the last 2 earnings calls were devoted to talk about the private fund business O is setting up. When asked about which acquisitions would go to the fund and which would go to O, Sumit Roy drew the distinction based on going in spreads.

Because there were certain transactions we chose to walk away from, which checked almost all the boxes except for the initial spread that we need to be able to do things on balance sheet. That is why we say that the fund business is complementary.

Essentially, O is not buying anything that doesn’t have an immediately accretive spread, even if the property looks promising in the longer term.

O got its near-term AFFO/share growth in the 2022-2024 period, but fundamentals suggest its growth will substantially lag that of peers going forward. As such, I continue to believe O is overvalued relative to peers, even as it trades in the middle of the pack.

This is not some sort of doomsday forecast. O is a large company with a highly diversified portfolio. It has positive cashflows and high margins. O is quite likely to generate a positive return to shareholders. I simply think the return will be disappointing compared to that of peers, which are better positioned for future growth due to their quality improvements of the past few years.

#Realty #Income #Dangers #Sacrosanct #Dividend #NYSEO