By Dan Steinbock

Despite de-escalation in Geneva, trillions of dollars may have been lost in the unwarranted trade wars.

In early May, international headlines reported on the meeting of U.S. Treasury Secretary Scott Bessent and chief trade negotiator Jamieson Greer and China’s economic tsar He Lifeng in Geneva, Switzerland.

Optimists saw the impending talks as the first step toward resolving a trade war, which was disrupting the global economy. By contrast, pessimists claimed talks would go nowhere as global prospects would edge ever-closer to an abyss. “A perfect economic storm might be coming our way,” warned foreign-policy analyst Fareed Zakaria who believed that the dollar’s status as a global reserve currency was under threat because of reckless spending. From this perspective, the tariff wars are a counter-productive distraction.

After two grueling days of bilateral marathon talks, Bessent said both sides had reached an agreement on a 90-day pause and substantially move down the tariff levels. In turn, Greer said the US agreed to drop the 145% tax Trump imposed last month to 30%, while China agreed to lower its tariff rate on U.S. goods to 10% from 125%.

The path to Geneva dates from early April when the tariffs wiped out over $6 trillion on Wall Street in just two days.

The caveats and the stakes

The extraordinary debacle began when President Trump launched the historically high tariffs, despite the opposition of many former national security leaders, leading American businesses and most consumers. The unilateral tariffs were not based on any existing international law or economics 101. They were the results of misguided methodologies and defective calculations, which the Trump aficionados believe will boost U.S. economic leverage and reshoring.

The first round of the Trump tariffs, which still mimicked traditional trade wars, involved mainly Canada, Mexico and China. The second round began with “reciprocal tariffs”, which rely on flawed methodologies and mistaken calculations, covering most trading economies worldwide. Then came the huge US retaliatory tariffs, which China countered.

Since starting his second term, Trump has slapped 145% tariffs on Chinese goods while Beijing has hit back with 125% duties on American products. That led bilateral trade to nearly dry up, unleashing fears of plunging global prospects.

From Beijing’s standpoint, which President Xi Jinping and other government leaders have often reiterated, retaliatory tariffs were not China’s first preference, but defensive moves to foster resilience and sovereignty. So, Geneva was not a venue for trade talks, but for a cautious tango. The two teams used the talks to estimate intent, identify red lines, and possible compromise areas before actual talks.

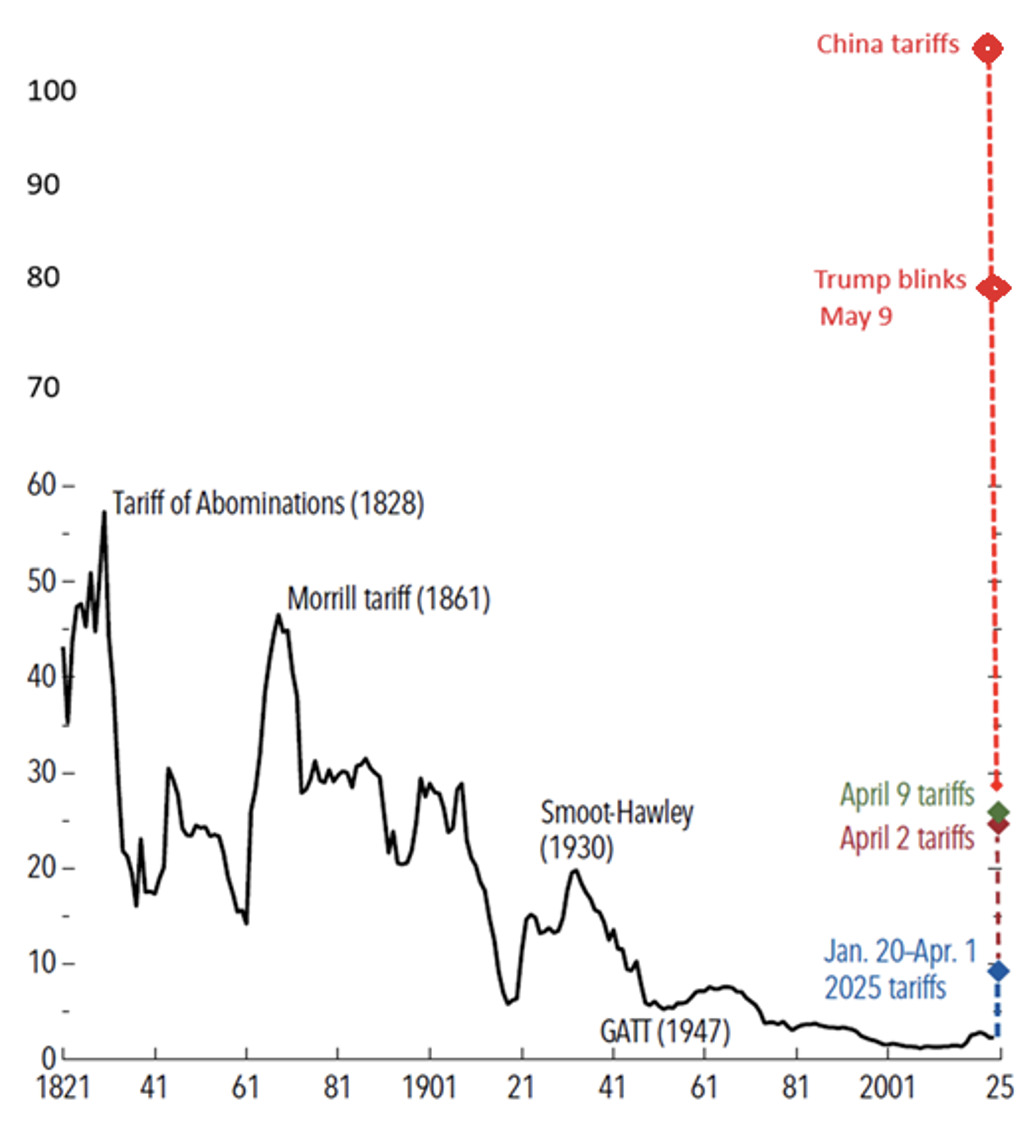

Before Geneva, the effective U.S. tariffs were the highest in a century, higher than the Smoot-Hawley tariffs (1930) that made the Great Depression a lot worse paving the way to World War II, Auschwitz, and Hiroshima. With respect to China, the pre-Geneva U.S. effective tariffs were 105%; 5-10 times higher than average U.S. tariffs with most of its large trading partners. That is, until Trump blinked before Geneva and suggested cutting China tariff rate to 80%.

Figure 1: US Effective Tariff Rates on All Imports

After the high-stakes trade talks, US dropped Trump’s 145% tax to 30%, as China lowered its tariff rate on US goods to 10% from 125%. Moreover, the two agreed to start a formal negotiation process, whereas Washington touted progress toward a deal. Furthermore, the two agreed to establish an “economic and trade consultation mechanism” that would involve recurring discussions.

Trump’s “total reset” dissected

Hailing the bilateral talks, Trump said the two sides had negotiated a “total reset.” It was smoke and mirrors for the faithful. The grandiose statements were meant to calm the markets where big investors were losing fortunes. It was all just a poor bargaining ploy. In reality, the institutional bilateral ties are half a century old.

With the end of the Cold War, the original motives underlying rapprochement between China and the United States diminished. Initially, President Nixon hoped to use the US-China ties against Moscow. These motives prevailed until the dissolution of the Soviet Union.

During his presidential campaign in 1992, Bill Clinton sharply criticized President George H. W. Bush for prioritizing trade over what he called human rights issues in China. Two years later, Clinton de-linked China’s “most favored nation” status from human rights issues, seeking to ensure American participation in the China boom and cheap prices.

As the bilateral economic ties broadened, the Strategic Economic Dialogue (SED) was initiated in 2006 by President George W. Bush and President Hu Jintao. But when the Bush era faded into history, so did the globalization decades. As the US-led West was swept with the dark days of the Greater Recession in 2008/9, it was the revenues of the US multinationals in China that played a role in the subsequent US recovery.

With the dramatic expansion of bilateral trade and investment, the dialogue was once again upgraded by the Obama administration, which redefined it U.S.–China Strategic and Economic Dialogue (S&ED). However, when Trump arrived in the White House in early 2017, he had the Obama administration’s S&ED renamed the Comprehensive Economic Dialogue in mid-2017.

Yet, in the subsequent months, the White House reversed half a century of US-China policies in tariff wars that targeted primarily China. In the process, Trump terminated the dialogue. As far as he was concerned, there was nothing to discuss. To the disappointment of Democratic progressives and globalists, President Biden built on Trump’s protectionism seeking to “multilateralize” it. When that failed, his administration struggled to de-escalate the trade mess they had created – just as President Trump’s team has struggled to de-escalate what they initially escalated.

What are the costs of the Trump follies?

The lost economic prospects

If the current tariffs prevail, global growth is expected to drop to 2.8% in 2025 and 3.0% in 2026 – down from 3.3% for both years since the January 2025 update by the International Monetary Fund (IMF). That translates to a cumulative downgrade of 0.8 percentage point, which is far below the historical (2000–19) average of 3.7 percent.

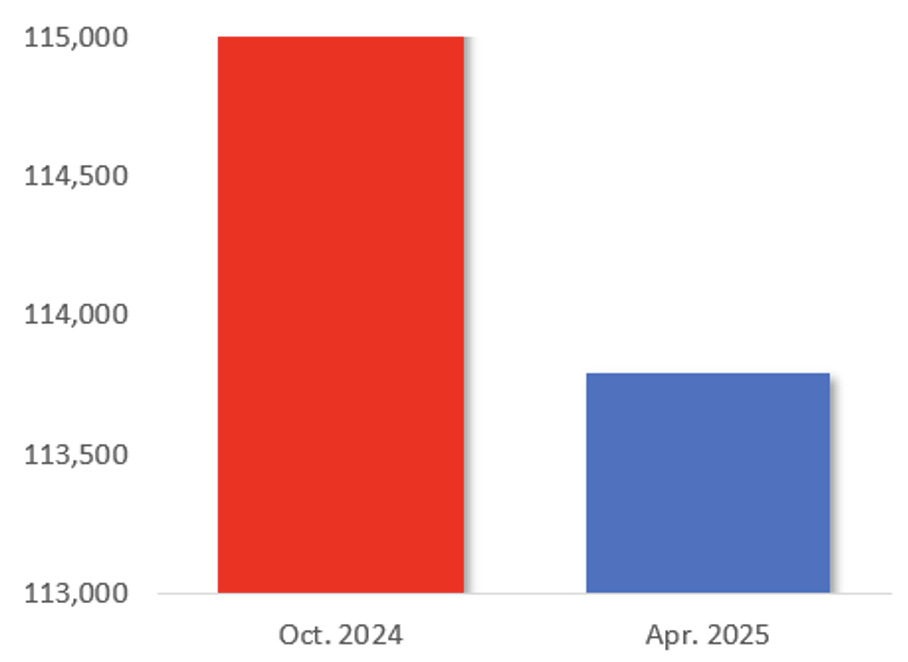

In October 2024, the IMF estimated the world economy to amount to $115.5 trillion by the end of 2025. Thanks particularly to the self-defeating tariff wars, it recently downgraded that figure to $113.8 trillion. That’s a difference of $1.7 trillion. What might it mean in practice?

Figure 2: World GDP 2025 Estimates (in $ billions)

Well, imagine the entire Spanish economy with its 50 million people suddenly – in a matter few months – dissolve into thin air. That’s what it means. Or think of South Korea, or Mexico. Each of these economies is about the same size.

In the developing economies of the Global South, the implications would be far more devastating. Imagine the combined economies of the Philippines, Egypt, Iran, Pakistan and Algeria (which together amount to about $1.7 trillion) and their almost 600 million people disappear from the face of the earth. That’s what it means.

The prospects of such economic losses are horrifying. As the major advanced economies in the West are already struggling at the edge of secular stagnation, such economic mismanagement will accelerate their economic misfortunes. In the Global South, the adverse consequences will be far worse.

The Trump tariffs are precisely the wrong thing in the wrong time. And they have only deferred the final trade showdown, which looms ahead in 90 days.

The original commentary was published by China-US Focus on April 14, 2025.

About the Author

Dr. Dan Steinbock is an internationally-renowned strategist of the multipolar world and the founder of Difference Group. He has served at the India, China and America Institute (US), Shanghai Institutes for International Studies (China) and the EU Center (Singapore). For more, see https://www.differencegroup.net

Dr. Dan Steinbock is an internationally-renowned strategist of the multipolar world and the founder of Difference Group. He has served at the India, China and America Institute (US), Shanghai Institutes for International Studies (China) and the EU Center (Singapore). For more, see https://www.differencegroup.net

#Trump #Tariffs #Global #Impact